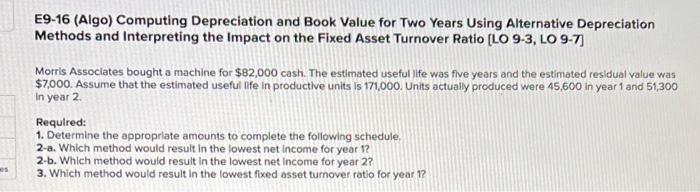

Question: E9-16 (Algo) Computing Depreciation and Book Value for Two Years Using Alternative Depreciation Methods and Interpreting the impact on the Fixed Asset Turnover Ratio [LO

E9-16 (Algo) Computing Depreciation and Book Value for Two Years Using Alternative Depreciation Methods and Interpreting the impact on the Fixed Asset Turnover Ratio [LO 9-3, LO 9-7) Morris Associates bought a machine for $82,000 cash. The estimated useful life was five years and the estimated residual value was $7,000. Assume that the estimated useful life in productive units is 171,000. Units actually produced were 45,600 in year 1 and 51,300 In year 2 Required: 1. Determine the appropriate amounts to complete the following schedule, 2-a. Which method would result in the lowest net income for year 1? 2-b. Which method would result in the lowest net income for year 2? 3. Which method would result in the lowest fixed asset turnover ratio for year 1

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts