Question: E9-30B. (Learning Objective 5: Evaluate debt-paying ability) Companies that operate in different industries may have very different financial ratio values. These differences may grow even

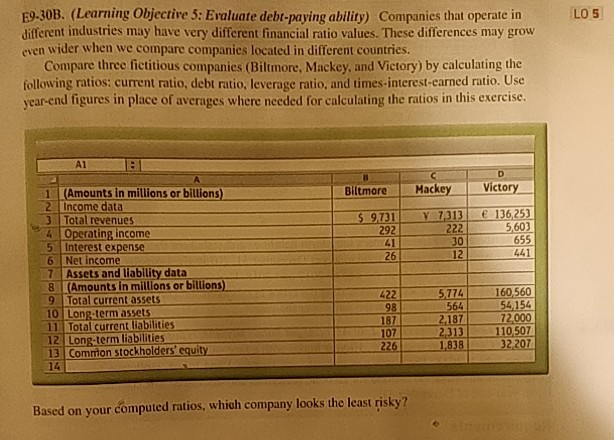

E9-30B. (Learning Objective 5: Evaluate debt-paying ability) Companies that operate in different industries may have very different financial ratio values. These differences may grow even wider when we compare companies located in different countries. 0 5 Compare three fictitious companies (Biltmore, Mackey and Victory) by calculating the following ratios: current ratio, debt ratio, leverage ratio, and times-interest-earned ratio. Use year-end figures in place of averages where needed for calculating the ratios in this exercise. A1 Biltmore Mackey 1 Victory 1 | (Amounts in millions or billions) 2 Income data 3 Total revenues 4 Operating income 5 Interest expense 6 Net income 7 Assets and liability data 9131 Y 7313 e 136,253 5603 655 441 292 41 26 30 12 8 (Amounts in milions or billions 9 Total current assets 422 98 774160560 54,154 564 10 Long.term assets 11 Total current liabilities 12 Long.term liabilities 13 Commion stockholders' equity 14 187 82313 32207 1072,187 110,507 226 Based on your computed ratios, whioh company looks the least risky

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts