Question: E9.9 Adjusting Entry Accrued Expense Using the QBO Sample Company, Craig's Design and Landscaping Services, complete the following Interest on Craig's Loan Payable has been

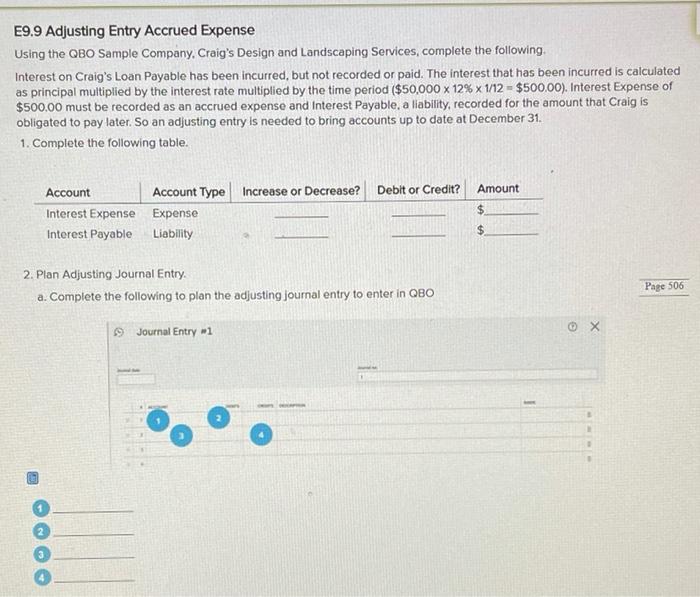

E9.9 Adjusting Entry Accrued Expense Using the QBO Sample Company, Craig's Design and Landscaping Services, complete the following Interest on Craig's Loan Payable has been incurred, but not recorded or paid. The interest that has been incurred is calculated as principal multiplied by the interest rate multiplied by the time period ($50,000 X 12% x 1/12 = $500,00). Interest Expense of $500.00 must be recorded as an accrued expense and Interest Payable, a liability, recorded for the amount that Craig is obligated to pay later. So an adjusting entry is needed to bring accounts up to date at December 31. 1. Complete the following table. Debitor Credit? Amount $ Account Account Type Increase or Decrease? Interest Expense Expense Interest Payable Liability $ 2. Plan Adjusting Journal Entry a. Complete the following to plan the adjusting journal entry to enter in QBO Page 506 9 Journal Entry #1 X

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts