Question: E9-9 (Static) Computing Depreciation under Alternative Methods [LO 9-3] Sonic Corporation purchased and installed electronic payment equipment at its drive-in restaurants in San Marcos. TX,

![E9-9 (Static) Computing Depreciation under Alternative Methods [LO 9-3] Sonic Corporation](https://dsd5zvtm8ll6.cloudfront.net/si.experts.images/questions/2024/09/66ea0c0eb11f3_54266ea0c0e4bdea.jpg)

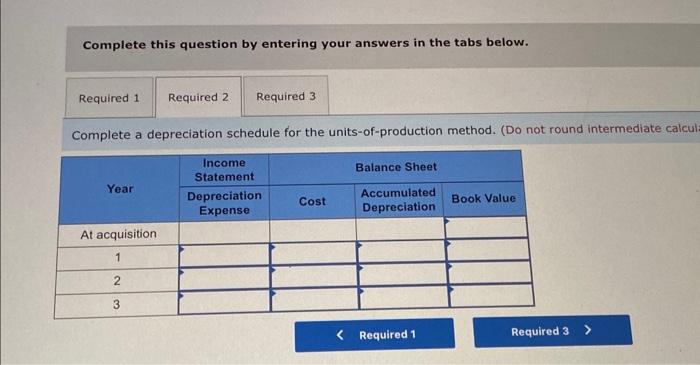

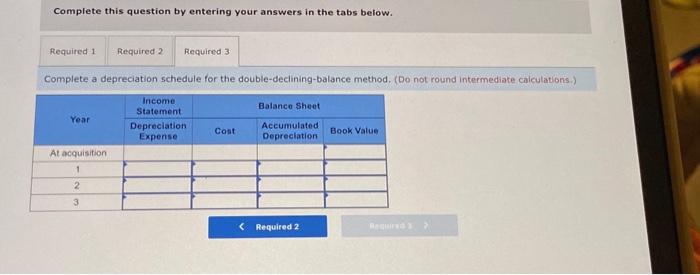

E9-9 (Static) Computing Depreciation under Alternative Methods [LO 9-3] Sonic Corporation purchased and installed electronic payment equipment at its drive-in restaurants in San Marcos. TX, at a cost of $27,000. The equipment has an estimated residual value of $1,500. The equipment is expected to process 255,000 payments over its three-year useful life. Per year, expected payment transactions are 61,200, year 1; 140,250 , year 2 ; and 53,550 , year 3 . Required: Complete a depreciation schedule for each of the aiternative methods. 1. Straight-line. 2. Units-of-production. 3. Double-declining-balance. Complete this question by entering your answers in the tabs below. Complete a depreciation schedule for the straight-line method. (Do not round intermediate calculations.) Complete this question by entering your answers in the tabs below. Complete a depreciation schedule for the units-of-production method. (Do not round intermediate calcu Complete this question by entering your answers in the tabs below. Complete a depreciation schedule for the double-declining-balance method. (Do not round intermediate calculations.)

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts