Question: E&A Corporation is preparing its master budget for the first quarter of 2022. The following data pertain to its operations: E&A Corporation is preparing its

E&A Corporation is preparing its master budget for the first quarter of 2022. The following data pertain to its operations:

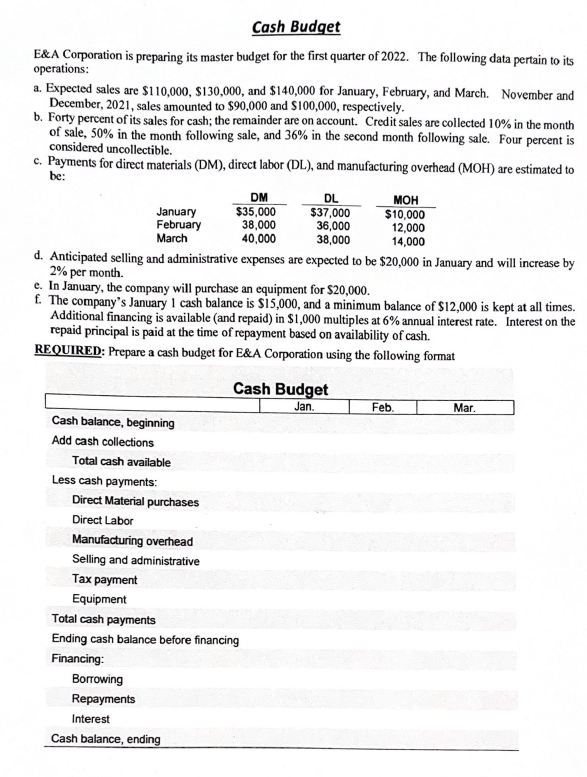

E\&A Corporation is preparing its master budget for the first quarter of 2022. The following data pertain to its operations: a. Expected sales are $110,000,$130,000, and $140,000 for January, February, and March. November and December, 2021, sales amounted to $90,000 and $100,000, respectively. b. Forty percent of its sales for cash; the remainder are on account. Credit sales are collected 10% in the month of sale, 50% in the month following sale, and 36% in the second month following sale. Four percent is considered uncollectible. c. Payments for direct materials (DM), direct labor (DL), and manufacturing overhead (MOH) are estimated to be: d. Anticipated selling and administrative expenses are expected to be $20,000 in January and will increase by 2% per month. e. In January, the company will purchase an equipment for $20,000. f. The company's January 1 cash balance is $15,000, and a minimum balance of $12,000 is kept at all times. Additional financing is available (and repaid) in $1,000 multiples at 6% annual interest rate. Interest on the repaid principal is paid at the time of repayment based on availability of cash. REQUIRED: Prepare a cash budget for E\&A Corporation using the following format

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts