Question: Each candidate (A, B, C) is provided Chrome's financial information (in $ million) presented below. Green asks each candidate to forecast the 2013 income statement

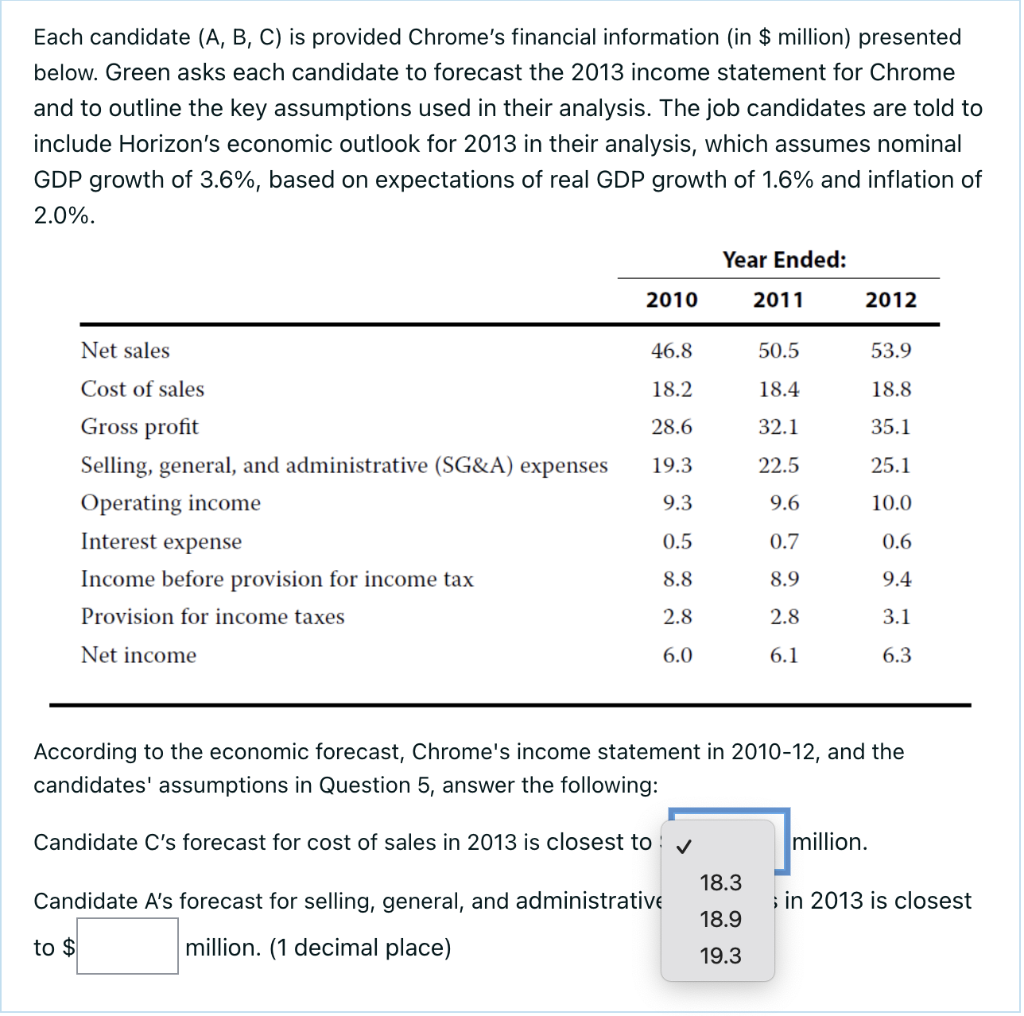

Each candidate (A, B, C) is provided Chrome's financial information (in $ million) presented below. Green asks each candidate to forecast the 2013 income statement for Chrome and to outline the key assumptions used in their analysis. The job candidates are told to include Horizon's economic outlook for 2013 in their analysis, which assumes nominal GDP growth of 3.6%, based on expectations of real GDP growth of 1.6% and inflation of 2.0%. Year Ended: 2010 2011 2012 Net sales 46.8 50.5 53.9 Cost of sales 18.2 18.4 18.8 28.6 32.1 35.1 19.3 22.5 25.1 9.3 9.6 10.0 Gross profit Selling, general, and administrative (SG&A) expenses Operating income Interest expense Income before provision for income tax Provision for income taxes 0.5 0.7 0.6 8.8 8.9 9.4 2.8 2.8 3.1 Net income 6.0 6.1 6.3 According to the economic forecast, Chrome's income statement in 2010-12, and the candidates' assumptions in Question 5, answer the following: Candidate C's forecast for cost of sales in 2013 is closest to million. 18.3 Candidate A's forecast for selling, general, and administrative ; in 2013 is closest 18.9 to $ million. (1 decimal place) 19.3

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts