Question: Each investment return must also be compared to a comparable benchmark to assess if the investment has over- or underperformed during the last 12 months.

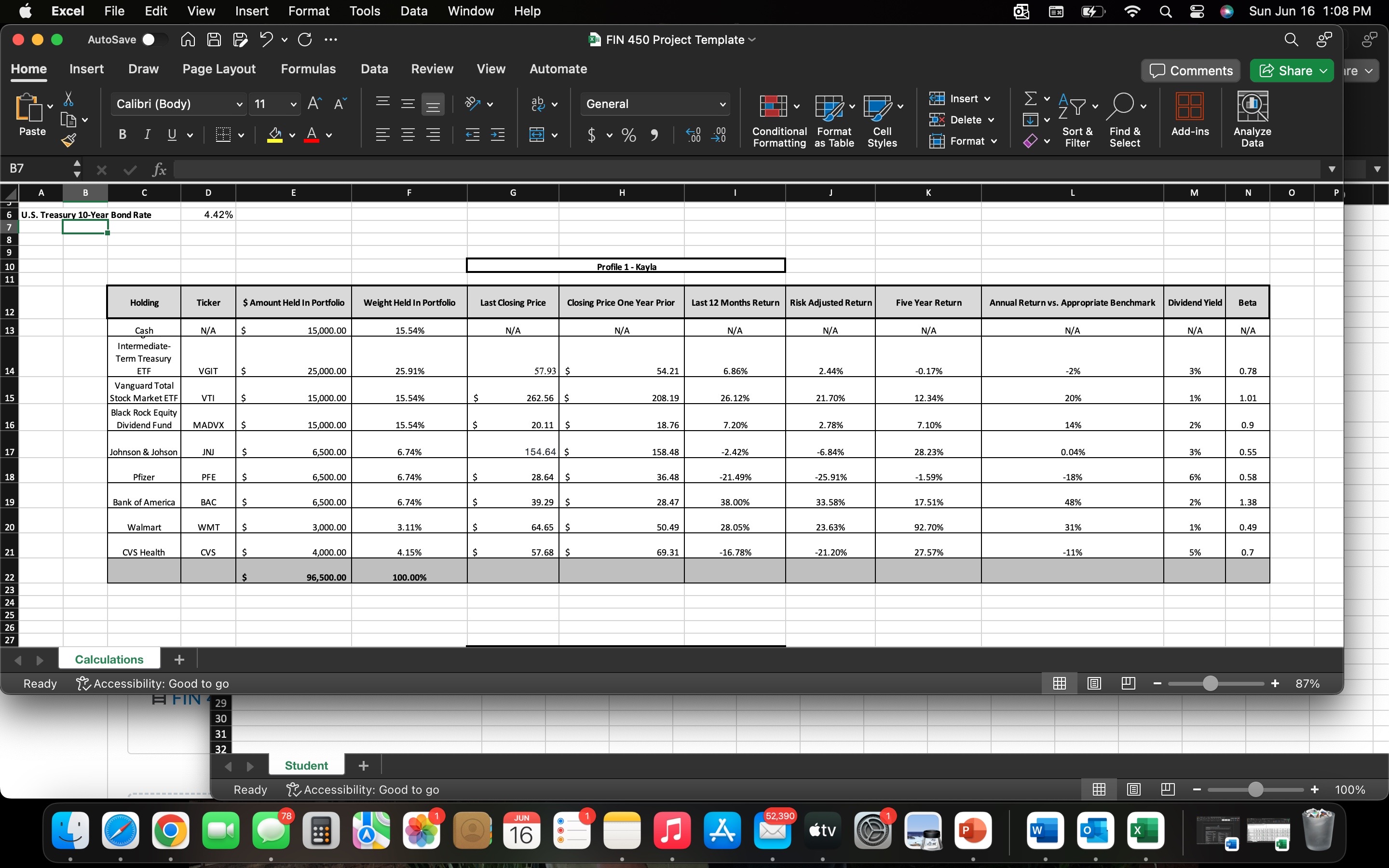

- Each investment return must also be compared to a comparable benchmark to assess if the investment has over- or underperformed during the last 12 months. You can compare the last 12-month return of your investment to the last 12-month return of a bond index when the investment is a bond, a large stock market index when the investment is a stock, or individual stocks when the investment is a stock, and so on. Find a comparable benchmark and enter the difference between the portfolio investment's return and the benchmark in column L.

Specifically, you must address the following rubric criteria:

- Analyze past portfolio performance. Include the following in your calculations:

- Quantitative assessments from:

- Annual return

- Risk-adjusted return

- Five-year return

- Annual return versus appropriate benchmark

- Quantitative assessments from:

- Compare portfolio investments to relevant benchmarks. Include the following in your calculations and summary:

- Identify benchmarks for existing investments to be compared to, and identify the reason for benchmark selection.

- Discuss return data on investments within the portfolio.

- Identify over- and underperforming investments in relation to each benchmark

Step by Step Solution

There are 3 Steps involved in it

1 Expert Approved Answer

Step: 1 Unlock

Question Has Been Solved by an Expert!

Get step-by-step solutions from verified subject matter experts

Step: 2 Unlock

Step: 3 Unlock