Question: Each multiple choice question is worth 3 points. 1. You would like to compare your firm's cost structure to that of your competitors. However, your

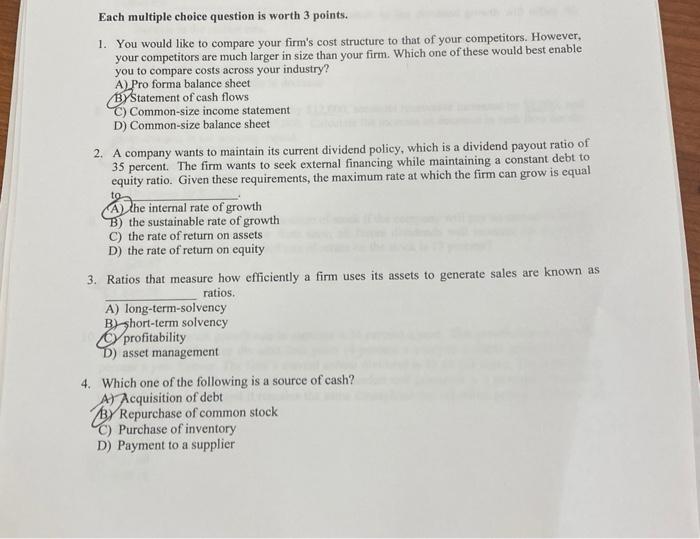

Each multiple choice question is worth 3 points. 1. You would like to compare your firm's cost structure to that of your competitors. However, your competitors are much larger in size than your firm. Which one of these would best enable you to compare costs across your industry? A Pro forma balance sheet By Statement of cash flows C) Common-size income statement D) Common-size balance sheet 2. A company wants to maintain its current dividend policy, which is a dividend payout ratio of 35 percent. The firm wants to seek external financing while maintaining a constant debt to equity ratio. Given these requirements, the maximum rate at which the firm can grow is equal A) the internal rate of growth B) the sustainable rate of growth C) the rate of return on assets D) the rate of return on equity 3. Ratios that measure how efficiently a firm uses its assets to generate sales are known as ratios. A) long-term-solvency B) short-term solvency profitability asset management 4. Which one of the following is a source of cash? Acquisition of debt By Repurchase of common stock C) Purchase of inventory D) Payment to a supplier

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts