Question: Each quarter, your US-based company sources materials from two different countries, UK and Mexico. The company purchases 50,000 units of production inputs from Mexico at

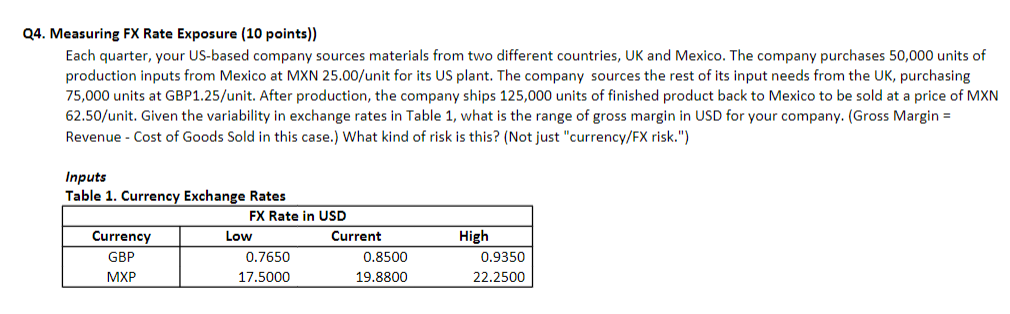

Each quarter, your US-based company sources materials from two different countries, UK and Mexico. The company purchases 50,000 units of production inputs from Mexico at MXN 25.00/unit for its US plant. The company sources the rest of its input needs from the UK, purchasing 75,000 units at GBP1.25/unit. After production, the company ships 125,000 units of finished product back to Mexico to be sold at a price of MXN 62.50/unit. Given the variability in exchange rates in Table 1, what is the range of gross margin in USD for your company. (Gross Margin = Revenue - Cost of Goods Sold in this case.) What kind of risk is this? (Not just "currency/FX risk.")

4. Measuring FX Rate Exposure (10 points)) Each quarter, your US-based company sources materials from two different countries, UK and Mexico. The company purchases 50,000 units of production inputs from Mexico at MXN 25.00/unit for its US plant. The company sources the rest of its input needs from the UK, purchasing 75,000 units at GBP1.25/unit. After production, the company ships 125,000 units of finished product back to Mexico to be sold at a price of M 62.50 /unit. Given the variability in exchange rates in Table 1, what is the range of gross margin in USD for your company. (Gross Revenue - Cost of Goods Sold in this case.) What kind of risk is this? (Not just "currency/FX risk.") Inputs Table 1. Currencv Exchanqe Rates 4. Measuring FX Rate Exposure (10 points)) Each quarter, your US-based company sources materials from two different countries, UK and Mexico. The company purchases 50,000 units of production inputs from Mexico at MXN 25.00/unit for its US plant. The company sources the rest of its input needs from the UK, purchasing 75,000 units at GBP1.25/unit. After production, the company ships 125,000 units of finished product back to Mexico to be sold at a price of M 62.50 /unit. Given the variability in exchange rates in Table 1, what is the range of gross margin in USD for your company. (Gross Revenue - Cost of Goods Sold in this case.) What kind of risk is this? (Not just "currency/FX risk.") Inputs Table 1. Currencv Exchanqe Rates

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts