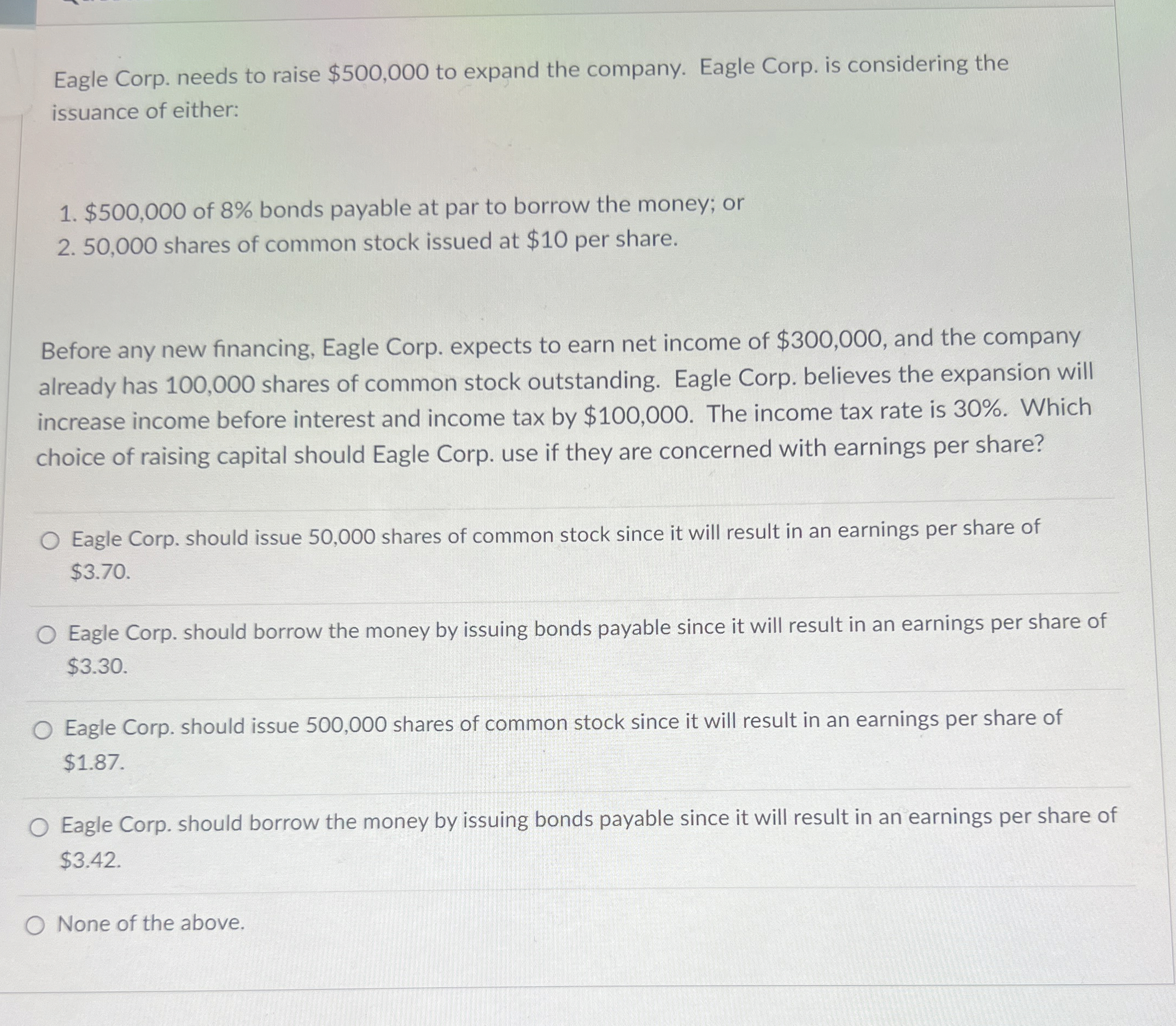

Question: Eagle Corp. needs to raise $ 5 0 0 , 0 0 0 to expand the company. Eagle Corp. is considering the issuance of either:

Eagle Corp. needs to raise $ to expand the company. Eagle Corp. is considering the issuance of either:

$ of bonds payable at par to borrow the money; or

shares of common stock issued at $ per share.

Before any new financing, Eagle Corp. expects to earn net income of $ and the company already has shares of common stock outstanding. Eagle Corp. believes the expansion will increase income before interest and income tax by $ The income tax rate is Which choice of raising capital should Eagle Corp. use if they are concerned with earnings per share?

Eagle Corp. should issue shares of common stock since it will result in an earnings per share of $

Eagle Corp. should borrow the money by issuing bonds payable since it will result in an earnings per share of $

Eagle Corp. should issue shares of common stock since it will result in an earnings per share of $

Eagle Corp. should borrow the money by issuing bonds payable since it will result in an earnings per share of $

None of the above.

Step by Step Solution

There are 3 Steps involved in it

1 Expert Approved Answer

Step: 1 Unlock

Question Has Been Solved by an Expert!

Get step-by-step solutions from verified subject matter experts

Step: 2 Unlock

Step: 3 Unlock