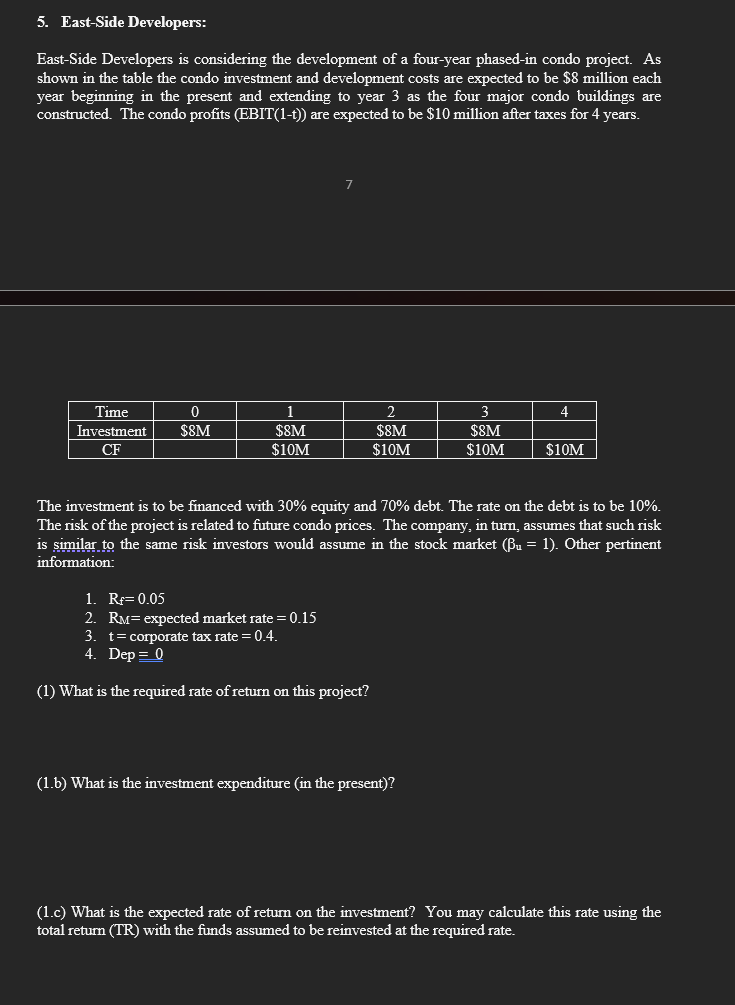

Question: East - Side Developers is considering the development of a four - year phased - in condo project. As shown in the table the condo

EastSide Developers is considering the development of a fouryear phasedin condo project. As

shown in the table the condo investment and development costs are expected to be $ million each

year beginning in the present and extending to year as the four major condo buildings are

constructed. The condo profits EBITt are expected to be $ million after taxes for years.

The investment is to be financed with equity and debt. The rate on the debt is to be

The risk of the project is related to future condo prices. The company, in turn, assumes that such risk

is similar to the same risk investors would assume in the stock market Other pertinent

information:

expected market rate

corporate tax rate

Dep

What is the required rate of return on this project?

b What is the investment expenditure in the present

c What is the expected rate of return on the investment? You may calculate this rate using the

total return TR with the funds assumed to be reinvested at the required rate.

Step by Step Solution

There are 3 Steps involved in it

1 Expert Approved Answer

Step: 1 Unlock

Question Has Been Solved by an Expert!

Get step-by-step solutions from verified subject matter experts

Step: 2 Unlock

Step: 3 Unlock