Question: Easy Finance Question. Please Answer all questions. Last Attempt Remaining. Please don't give wrong answer Question 9 (1 point) Listen A stock has a beta

Easy Finance Question. Please Answer all questions. Last Attempt Remaining. Please don't give wrong answer

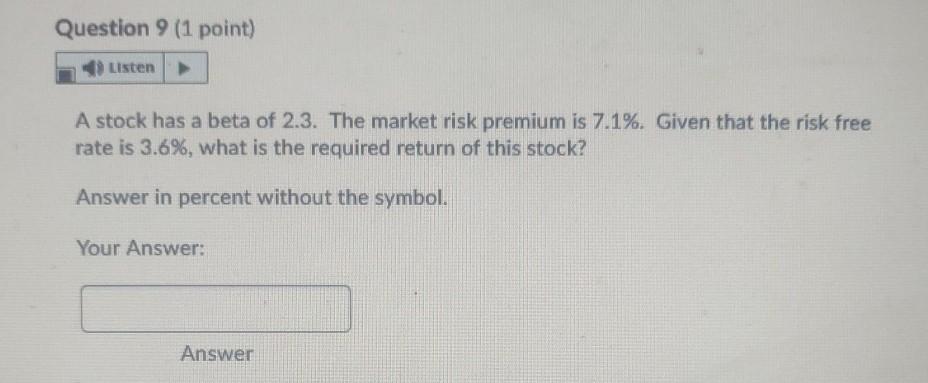

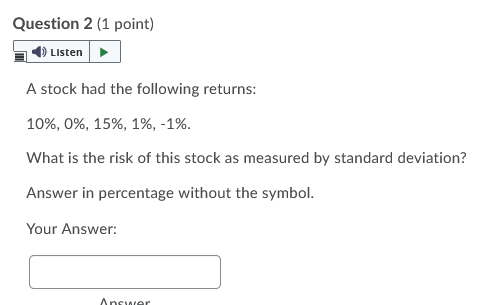

Question 9 (1 point) Listen A stock has a beta of 2.3. The market risk premium is 7.1%. Given that the risk free rate is 3.6%, what is the required return of this stock? Answer in percent without the symbol. Your Answer: Answer Question 2 (1 point) Listen A stock had the following returns: 10%, 0%, 15%, 1%, -1%. What is the risk of this stock as measured by standard deviation? Answer in percentage without the symbol. Your Answer: Ancier

Step by Step Solution

There are 3 Steps involved in it

1 Expert Approved Answer

Step: 1 Unlock

Question Has Been Solved by an Expert!

Get step-by-step solutions from verified subject matter experts

Step: 2 Unlock

Step: 3 Unlock