Question: Easy question help. need help in 30 minutes please As a firm grows, It must support increases in revenue with new Investments in assets. The

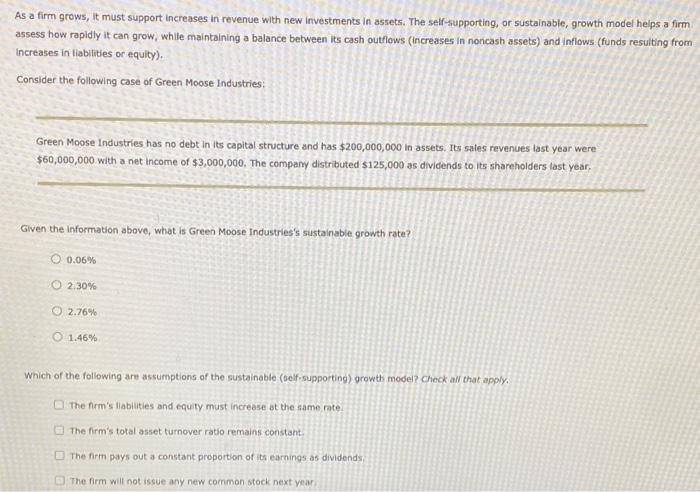

As a firm grows, It must support increases in revenue with new Investments in assets. The self-supporting, or sustainable, growth model helps a firm assess how rapidly it can grow, while maintaining a balance between its cash outflows (Increases in noncash assets) and inflows. (funds resulting from Increases in liabilities or equity). Consider the following case of Green Moose Industries: Green Moose Industries has no debt in its capital structure and has $200,000,000 in assets. Its sales revenues last year were $60,000,000 with a net income of $3,000,000. The company distributed $125,000 as dividends to its shareholders last year, Given the information above, what Green Moose Industries's sustainable growth rate? 0.06% O 2.30% 2.76% O 1.46% Which of the following are assumptions of the sustainable (self supporting) growth model? Check all that apply, The rm's liabilities and equity must increase at the same rate The firm's total asset turnover ratio remains constant. The firm pays out a constant proportion of its earnings as dividends The firm will not issue any new common stock next year

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts