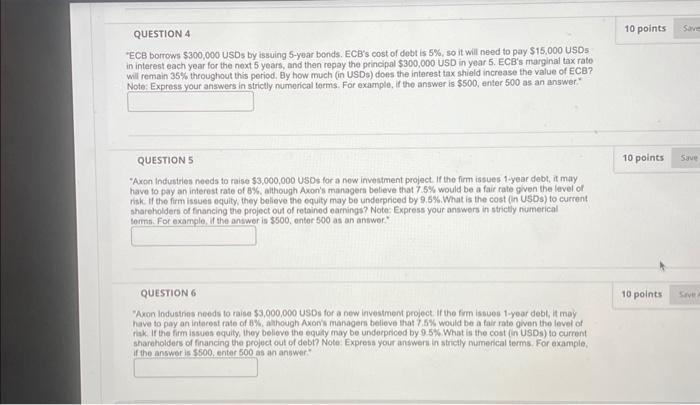

Question: EB borrows $300,000 USDs by issuing 5 -year bonds. ECB's cost of dobt is 5%, so it will need to pay $15,000 USO5 in interest

EB borrows $300,000 USDs by issuing 5 -year bonds. ECB's cost of dobt is 5%, so it will need to pay $15,000 USO5 in interest each year for the next 5 years, and then repay the principal $300,000 USD in year 5 . ECB's marginat tax rate wil remain 35% throughout this period. By how much (in USDs) does the interest tax shleld increase the value of ECB? Note: Exaress vour answers in strictly numorical terms. For example, if tho answer is $500, enter 500 as an answer." QUESTION 5 "Axon Industries needs to raise $3,000,000 USOs for a now investment project. If the firm issues 1-year debt, it may have to pay an interest rate of 8%, although Avon's managers believe that 7.5% would be a fair cate given the level of rik. It the firm issues equily, they believe the equity may be underpriced by 9.5%. What is the cost (in USDS) to current shareholders of financing the project out of retained earnings? Note: Express your answers in strictly numerical termin. For examele. if the antwor is $500, enter 500 as an answor." QUESTION 6 "Axon industrins needi to raise $3,000,000 USOs for a new investment project if the firm issues 1-year debl, it may have to pay an interent rate of 8%, Although Axoms managers beliove that 7.5% would be a fair rate given the level of tiak. If the firm issues equily, they beliove the equaly may be underpriced by 9.5%. What is the cost (n USDs) to current shareholders of financing the project out of debt? Note. Express your answers in strictly numerical terms. For axample. if the answer is $500. enter 500 as an anower:" EB borrows $300,000 USDs by issuing 5 -year bonds. ECB's cost of dobt is 5%, so it will need to pay $15,000 USO5 in interest each year for the next 5 years, and then repay the principal $300,000 USD in year 5 . ECB's marginat tax rate wil remain 35% throughout this period. By how much (in USDs) does the interest tax shleld increase the value of ECB? Note: Exaress vour answers in strictly numorical terms. For example, if tho answer is $500, enter 500 as an answer." QUESTION 5 "Axon Industries needs to raise $3,000,000 USOs for a now investment project. If the firm issues 1-year debt, it may have to pay an interest rate of 8%, although Avon's managers believe that 7.5% would be a fair cate given the level of rik. It the firm issues equily, they believe the equity may be underpriced by 9.5%. What is the cost (in USDS) to current shareholders of financing the project out of retained earnings? Note: Express your answers in strictly numerical termin. For examele. if the antwor is $500, enter 500 as an answor." QUESTION 6 "Axon industrins needi to raise $3,000,000 USOs for a new investment project if the firm issues 1-year debl, it may have to pay an interent rate of 8%, Although Axoms managers beliove that 7.5% would be a fair rate given the level of tiak. If the firm issues equily, they beliove the equaly may be underpriced by 9.5%. What is the cost (n USDs) to current shareholders of financing the project out of debt? Note. Express your answers in strictly numerical terms. For axample. if the answer is $500. enter 500 as an anower

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts