Question: (EBIT-EPS analysis) Three recent graduates of the computer science program at the University of Tennessee are forming a company that will write and distribute new

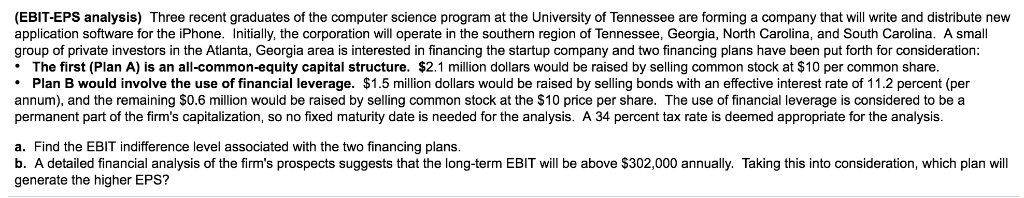

(EBIT-EPS analysis) Three recent graduates of the computer science program at the University of Tennessee are forming a company that will write and distribute new application software for the iPhone. Initially, the corporation will operate in the southern region of Tennessee, Georgia, North Carolina, and South Carolina. A small group of private investors in the Atlanta, Georgia area is interested in financing the startup company and two financing plans have been put forth for consideration The first (Plan A) is an all-common-equity capital structure. $2.1 million dollars would be raised by selling common stock at $10 per common share Plan B would involve the use of financial leverage. $1.5 million dollars would be raised by selling bonds with an effective interest rate of 11.2 percent (per annum), and the remaining $0.6 million would be raised by selling common stock at the $10 price per share. The use of financial leverage is considered to be a permanent part of the firm's capitalization, so no fixed maturity date is needed for the analysis. A 34 percent tax rate is deemed appropriate for the analysis a. Find the EBIT indifference level associated with the two financing plans A detailed financial analysis of the firm's prospects suggests that the long-term EBIT will be above $302,000 annually. Taking this into consideration, which plan will generate the higher EPS

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts