Question: eblook Discussion Question 5 - 1 1 ( LO . 2 ) Ted works for Azure Motors, an automobile dealership. All employees can buy a

eblook

Discussion Question LO

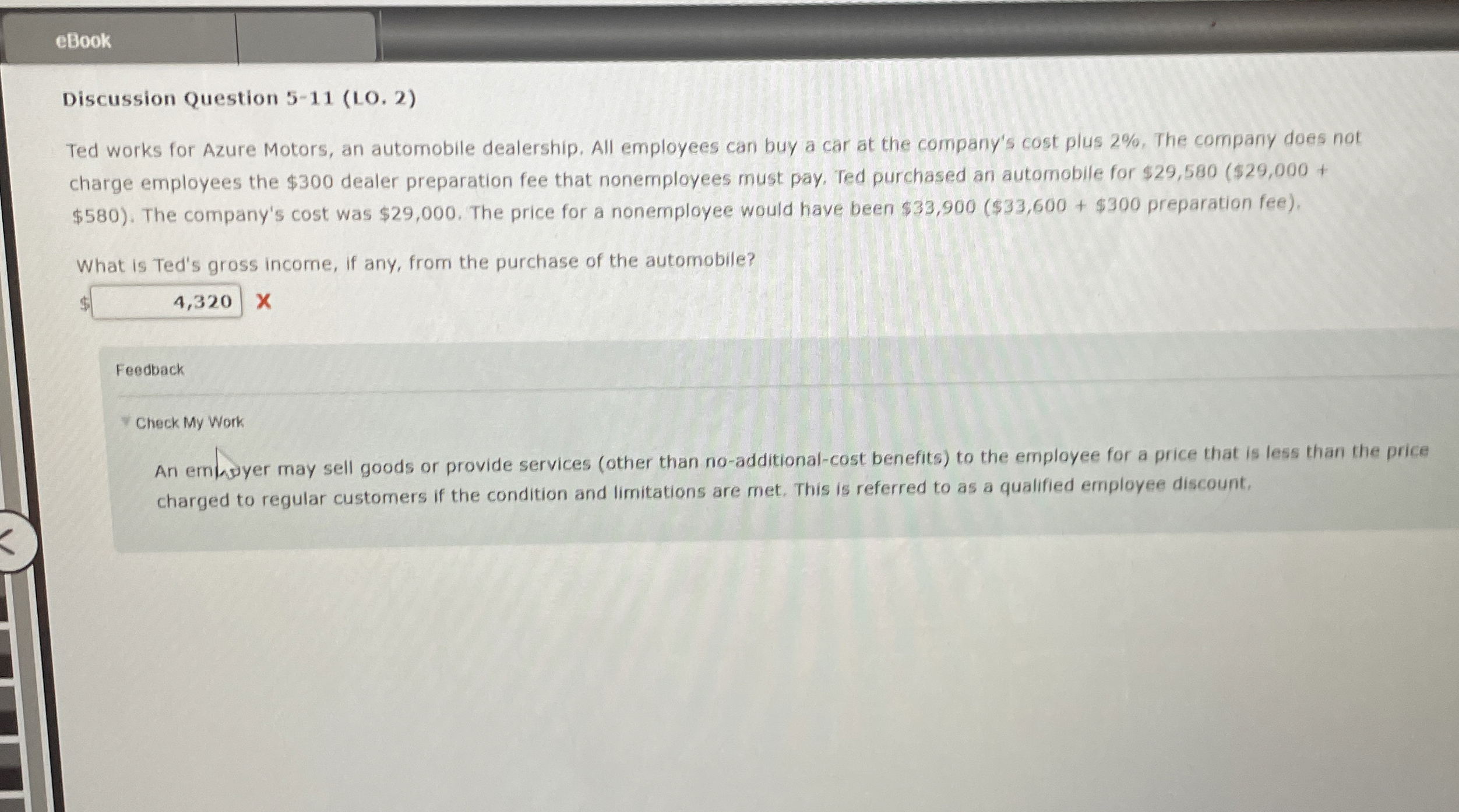

Ted works for Azure Motors, an automobile dealership. All employees can buy a car at the company's cost plus The company does not charge employees the $ dealer preparation fee that nonemployees must pay. Ted purchased an automobile for $ $ $ The company's cost was $ The price for a nonemployee would have been $ $$ preparation fee

What is Ted's gross income, if any, from the purchase of the automobile?

Feedback

Check My Work

An empyer may sell goods or provide services other than noadditionalcost benefits to the employee for a price that is less than the price charged to regular customers if the condition and limitations are met. This is referred to as a qualified employee discount.

Step by Step Solution

There are 3 Steps involved in it

1 Expert Approved Answer

Step: 1 Unlock

Question Has Been Solved by an Expert!

Get step-by-step solutions from verified subject matter experts

Step: 2 Unlock

Step: 3 Unlock