Question: eBock Print Item Discussion Question 3 - 2 3 ( L . 7 ) In the current year, Woodpecker, Inc., a C corporation with $

eBock

Print Item

Discussion Question L

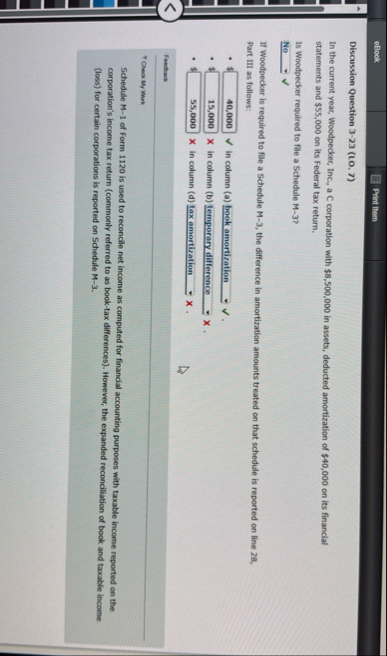

In the current year, Woodpecker, Inc., a C corporation with $ in assets, deducted amortization of $ on its financial statements and $ on its Federal tax return.

Is Woodpecker required to file a Schedule M

If Woodpecker is required to file a Schedule M the difference in amortization amounts treated on that schedule is reported on line

Part III as follows:

in column a book amortization

X in column b temporary difference

X in column d tax amortization

Feedhack

Chack My Work

Schedule M of Form is used to reconcile net income as computed for financial accounting purposes with taxable income reported on the corporation's income tax return commonly referred to as booktax differences However, the expanded reconciliation of book and taxable income loss for certain corporations is reported on Schedule M

Step by Step Solution

There are 3 Steps involved in it

1 Expert Approved Answer

Step: 1 Unlock

Question Has Been Solved by an Expert!

Get step-by-step solutions from verified subject matter experts

Step: 2 Unlock

Step: 3 Unlock