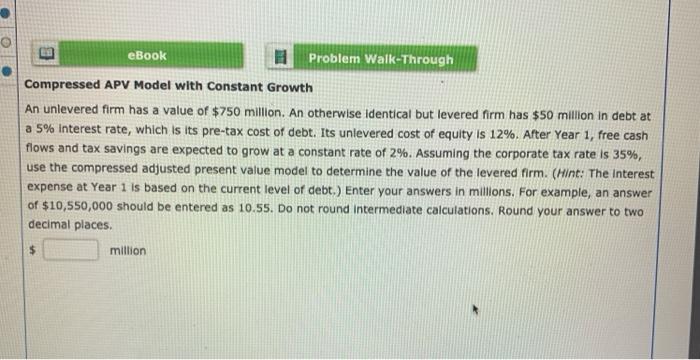

Question: eBook 11 Problem Walk-Through Compressed APV Model with Constant Growth An unlevered firm has a value of $750 million. An otherwise identical but levered firm

eBook 11 Problem Walk-Through Compressed APV Model with Constant Growth An unlevered firm has a value of $750 million. An otherwise identical but levered firm has $50 million in debt at a 5% Interest rate, which is its pre-tax cost of debt. Its unlevered cost of equity is 12%. After Year 1, free cash flows and tax savings are expected to grow at a constant rate of 2%. Assuming the corporate tax rate is 35%, use the compressed adjusted present value model to determine the value of the levered firm. (Hint: The Interest expense at Year 1 is based on the current level of debt.) Enter your answers in millions. For example, an answer of $10,550,000 should be entered as 10.55. Do not round Intermediate calculations. Round your answer to two decimal places million

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts