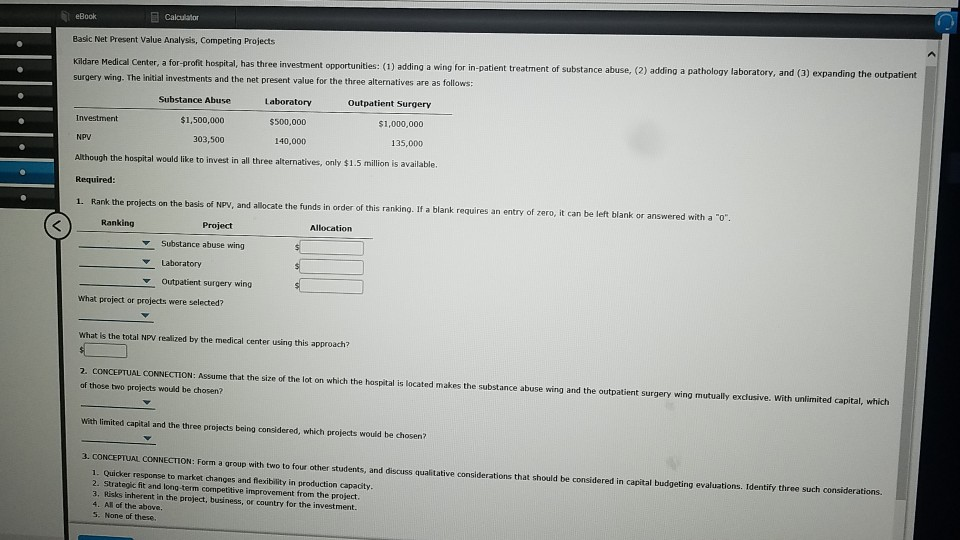

Question: eBook Calculator Basic Net Present Value Analysis, Competing Projects Kildare Medical Center, a for-profit hospital, has thr surgery wing. The initial investments and the re

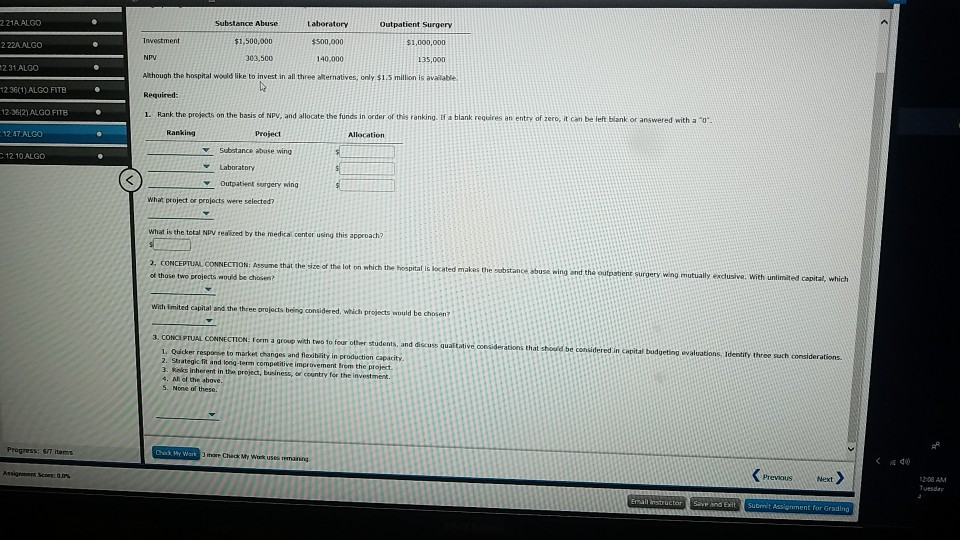

eBook Calculator Basic Net Present Value Analysis, Competing Projects Kildare Medical Center, a for-profit hospital, has thr surgery wing. The initial investments and the re investment opportunities: (1) adding a wing for in-patient treatment of substance abuse, (2) adding a pathology laboratory, and (3) expanding the outpatient net present value for the three alternatives are as follows Substance Abuse Laboratory Outpatient Surgery $1,500,000 $500,000 $1,000,000 303,500 140,000 135,000 NPV Although the hospital Required: 1. Rank I would like to invest in all three alternatives, only $1.5 million is available allocate the funds in order of this ranking. If a blank requires an entry of zero, it carn be left blank or answered with a "o Ranking Project Allocation Substance abuse wing Outpatient surgery wing what project or projects were selected? What is the total NPV realized by the medical center using this approach? 2. CONCEPTUAL CONNECTION: Assume that the size of the lot on which the hospital is located makes the substance abuse wing and the outpatient surgery wing mutually exclusive. With unlimited capital, which of those two projects would be chosen? With limited capital and the three projects being considered, which projects would be chosen? 3. CONCEPTUAL CONNECTION: Form a group with two to four other students, and discuss qualitative considerations that should be considered in capital budgeting evaluations. Identify three such considerations. 1. Quicker response to market changes and flexibility in production capacty 2. Strategic fit and long-term competitive improvement from the project 3. Risks inherent in the project, business, or country for the investment. 4. All of the above. 5. None of these. 2 21A ALGO $1,500,000 $1,000,0D0 222A ALGO 303,500 140,000 135,000 2.31 ALGO 12 36(1) ALGO.FITB 12-36/2) ALGO FITE 2.47 ALGO Although the hospital would like to invest in all three aternatives, only $1.5 million is available Required: 1. Rank the projects on the basis of NPV, and allocate the funds in order of this ranking. If a blank requires an entry of zero, it can be left blank or answered with a o Project Subatance abuse wing 1210 ALGO Outpatient surgery wing What project or projects were selected? What is the total NPV realzed by the medical center using this approach? . CONCEPTUAL CONNECTION: Assume that the size of the lot on which t ot thase two projects would be chosen? es the ubitance abuse wing and the outpstient surgery w wing mutually exclusive. With unlimited capital, which Wiah imited capital and the three projects being considered, which projects would be chasen? 3. CONCIPTUAL CONNECTION: Form a group with two to four other students, and discuss qualtative conaiderations that shou'd be considered in capital 1, Quicker response to market changes and flexibaity in production capacity. 2. Strategke fit and long-term competitive improvement frem the project 3. koks inherent in the project, business, ee country for the investment. 4. Al ot the above 5. None of these. Progress: sn Itams more Chick My Work uses t manng 12-08 AM Tuesday PreviouS Next sson ment Scare: 0.0% eand ExitSubmit Assignment for G eBook Calculator Basic Net Present Value Analysis, Competing Projects Kildare Medical Center, a for-profit hospital, has thr surgery wing. The initial investments and the re investment opportunities: (1) adding a wing for in-patient treatment of substance abuse, (2) adding a pathology laboratory, and (3) expanding the outpatient net present value for the three alternatives are as follows Substance Abuse Laboratory Outpatient Surgery $1,500,000 $500,000 $1,000,000 303,500 140,000 135,000 NPV Although the hospital Required: 1. Rank I would like to invest in all three alternatives, only $1.5 million is available allocate the funds in order of this ranking. If a blank requires an entry of zero, it carn be left blank or answered with a "o Ranking Project Allocation Substance abuse wing Outpatient surgery wing what project or projects were selected? What is the total NPV realized by the medical center using this approach? 2. CONCEPTUAL CONNECTION: Assume that the size of the lot on which the hospital is located makes the substance abuse wing and the outpatient surgery wing mutually exclusive. With unlimited capital, which of those two projects would be chosen? With limited capital and the three projects being considered, which projects would be chosen? 3. CONCEPTUAL CONNECTION: Form a group with two to four other students, and discuss qualitative considerations that should be considered in capital budgeting evaluations. Identify three such considerations. 1. Quicker response to market changes and flexibility in production capacty 2. Strategic fit and long-term competitive improvement from the project 3. Risks inherent in the project, business, or country for the investment. 4. All of the above. 5. None of these. 2 21A ALGO $1,500,000 $1,000,0D0 222A ALGO 303,500 140,000 135,000 2.31 ALGO 12 36(1) ALGO.FITB 12-36/2) ALGO FITE 2.47 ALGO Although the hospital would like to invest in all three aternatives, only $1.5 million is available Required: 1. Rank the projects on the basis of NPV, and allocate the funds in order of this ranking. If a blank requires an entry of zero, it can be left blank or answered with a o Project Subatance abuse wing 1210 ALGO Outpatient surgery wing What project or projects were selected? What is the total NPV realzed by the medical center using this approach? . CONCEPTUAL CONNECTION: Assume that the size of the lot on which t ot thase two projects would be chosen? es the ubitance abuse wing and the outpstient surgery w wing mutually exclusive. With unlimited capital, which Wiah imited capital and the three projects being considered, which projects would be chasen? 3. CONCIPTUAL CONNECTION: Form a group with two to four other students, and discuss qualtative conaiderations that shou'd be considered in capital 1, Quicker response to market changes and flexibaity in production capacity. 2. Strategke fit and long-term competitive improvement frem the project 3. koks inherent in the project, business, ee country for the investment. 4. Al ot the above 5. None of these. Progress: sn Itams more Chick My Work uses t manng 12-08 AM Tuesday PreviouS Next sson ment Scare: 0.0% eand ExitSubmit Assignment for G

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts