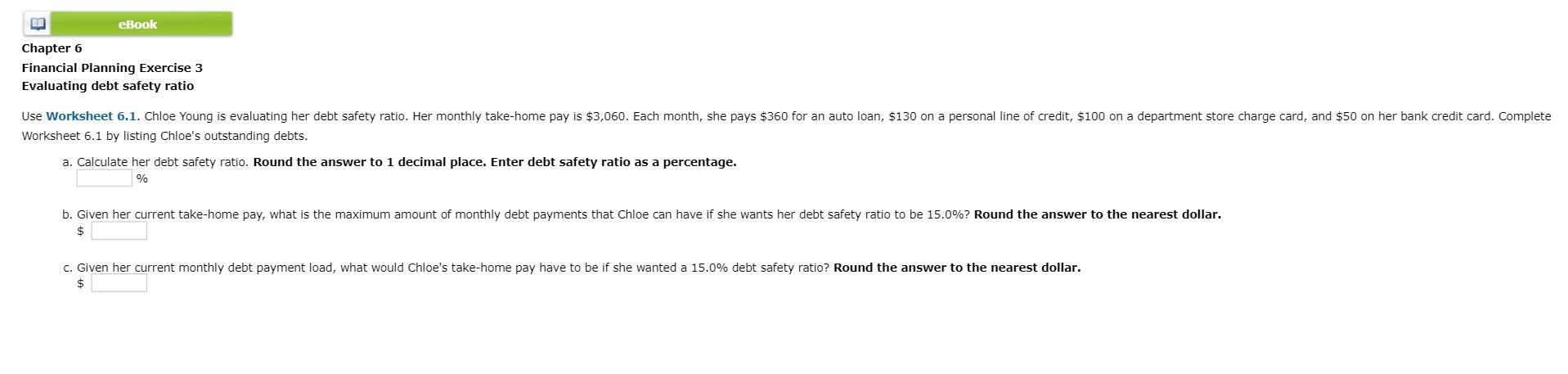

Question: eBook Chapter 6 Financial Planning Exercise 3 Evaluating debt safety ratio Use Worksheet 6.1. Chloe Young is evaluating her debt safety ratio. Her monthly

eBook Chapter 6 Financial Planning Exercise 3 Evaluating debt safety ratio Use Worksheet 6.1. Chloe Young is evaluating her debt safety ratio. Her monthly take-home pay is $3,060. Each month, she pays $360 for an auto loan, $130 on a personal line of credit, $100 on a department store charge card, and $50 on her bank credit card. Complete Worksheet 6.1 by listing Chloe's outstanding debts. a. Calculate her debt safety ratio. Round the answer to 1 decimal place. Enter debt safety ratio as a percentage. % b. Given her current take-home pay, what is the maximum amount of monthly debt payments that Chloe can have if she wants her debt safety ratio to be 15.0%? Round the answer to the nearest dollar. $ c. Given her current monthly debt payment load, what would Chloe's take-home pay have to be if she wanted a 15.0% debt safety ratio? Round the answer to the nearest dollar. $

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts