Question: eBook Check my workCheck My Work button is now enabled1 Item 3 Sun Corporation was created on January 1, 20X2, and quickly became successful. On

eBook

Check my workCheck My Work button is now enabled1

Item 3

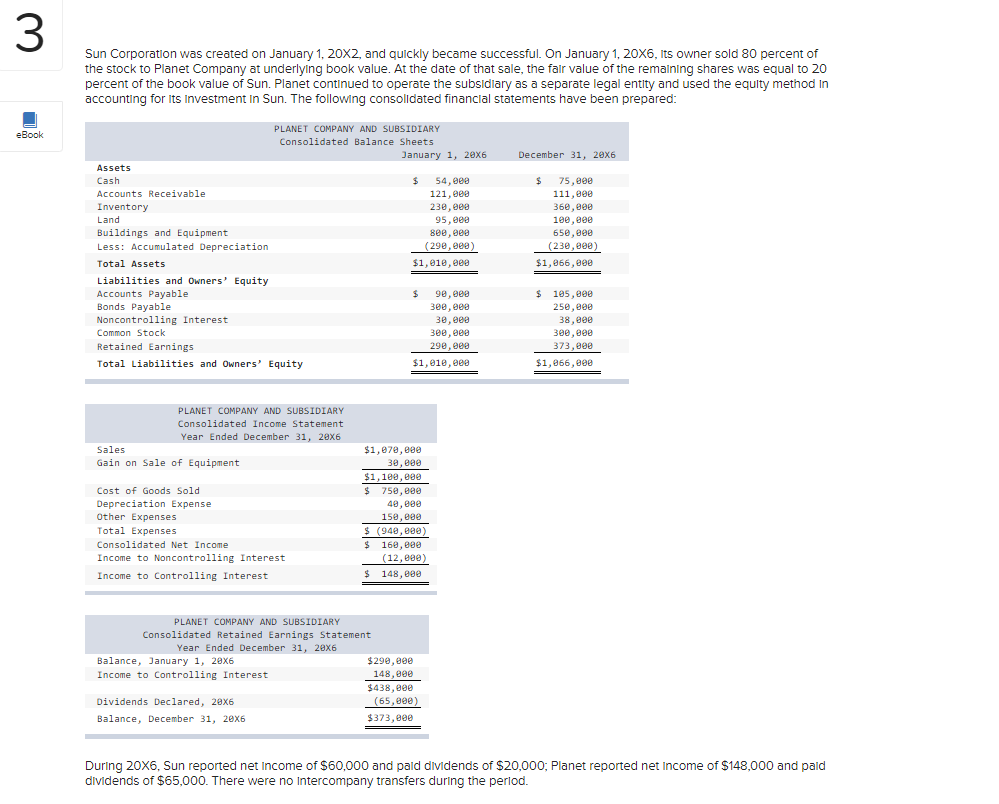

Sun Corporation was created on January 1, 20X2, and quickly became successful. On January 1, 20X6, its owner sold 80 percent of the stock to Planet Company at underlying book value. At the date of that sale, the fair value of the remaining shares was equal to 20 percent of the book value of Sun. Planet continued to operate the subsidiary as a separate legal entity and used the equity method in accounting for its investment in Sun. The following consolidated financial statements have been prepared:

| PLANET COMPANY AND SUBSIDIARY Consolidated Balance Sheets | ||||||||||

| January 1, 20X6 | December 31, 20X6 | |||||||||

| Assets | ||||||||||

| Cash | $ | 54,000 | $ | 75,000 | ||||||

| Accounts Receivable | 121,000 | 111,000 | ||||||||

| Inventory | 230,000 | 360,000 | ||||||||

| Land | 95,000 | 100,000 | ||||||||

| Buildings and Equipment | 800,000 | 650,000 | ||||||||

| Less: Accumulated Depreciation | (290,000 | ) | (230,000 | ) | ||||||

| Total Assets | $ | 1,010,000 | $ | 1,066,000 | ||||||

| Liabilities and Owners Equity | ||||||||||

| Accounts Payable | $ | 90,000 | $ | 105,000 | ||||||

| Bonds Payable | 300,000 | 250,000 | ||||||||

| Noncontrolling Interest | 30,000 | 38,000 | ||||||||

| Common Stock | 300,000 | 300,000 | ||||||||

| Retained Earnings | 290,000 | 373,000 | ||||||||

| Total Liabilities and Owners Equity | $ | 1,010,000 | $ | 1,066,000 | ||||||

| PLANET COMPANY AND SUBSIDIARY Consolidated Income Statement Year Ended December 31, 20X6 | ||||

| Sales | $ | 1,070,000 | ||

| Gain on Sale of Equipment | 30,000 | |||

| $ | 1,100,000 | |||

| Cost of Goods Sold | $ | 750,000 | ||

| Depreciation Expense | 40,000 | |||

| Other Expenses | 150,000 | |||

| Total Expenses | $ | (940,000 | ) | |

| Consolidated Net Income | $ | 160,000 | ||

| Income to Noncontrolling Interest | (12,000 | ) | ||

| Income to Controlling Interest | $ | 148,000 | ||

| PLANET COMPANY AND SUBSIDIARY Consolidated Retained Earnings Statement Year Ended December 31, 20X6 | ||||

| Balance, January 1, 20X6 | $ | 290,000 | ||

| Income to Controlling Interest | 148,000 | |||

| $ | 438,000 | |||

| Dividends Declared, 20X6 | (65,000 | ) | ||

| Balance, December 31, 20X6 | $ | 373,000 | ||

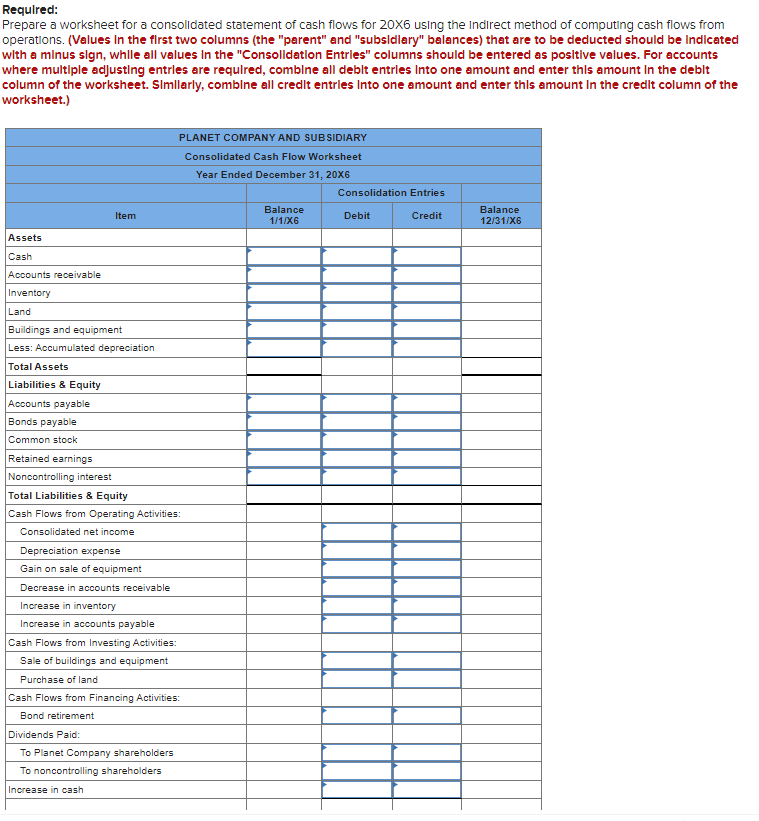

During 20X6, Sun reported net income of $60,000 and paid dividends of $20,000; Planet reported net income of $148,000 and paid dividends of $65,000. There were no intercompany transfers during the period. Required: Prepare a worksheet for a consolidated statement of cash flows for 20X6 using the indirect method of computing cash flows from operations. (Values in the first two columns (the "parent" and "subsidiary" balances) that are to be deducted should be indicated with a minus sign, while all values in the "Consolidation Entries" columns should be entered as positive values. For accounts where multiple adjusting entries are required, combine all debit entries into one amount and enter this amount in the debit column of the worksheet. Similarly, combine all credit entries into one amount and enter this amount in the credit column of the worksheet.)

I have little to no clue on how to do this, if someone can help me and complete it, I'd appreciate it thank you.

I have little to no clue on how to do this, if someone can help me and complete it, I'd appreciate it thank you.

3 Sun Corporation was created on January 1, 20x2, and quickly became successful. On January 1, 20X6, its owner sold 80 percent of the stock to Planet Company at underlying book value. At the date of that sale, the fair value of the remaining shares was equal to 20 percent of the book value of Sun. Planet continued to operate the subsidiary as a separate legal entity and used the equity method in accounting for its Investment In Sun. The following consolidated financial statements have been prepared: eBook December 31, 20X6 PLANET COMPANY AND SUBSIDIARY Consolidated Balance Sheets January 1, 20x6 Assets Cash $ 54, eee Accounts Receivable 121, wee Inventory 230,00 Land 95, eee Buildings and Equipment 8ee, eee Less: Accumulated Depreciation (290,000) Total Assets $1,1e, eee Liabilities and Owners' Equity Accounts Payable $ 90, eee Bonds Payable 3ee, eee Noncontrolling Interest 30,00 Common Stock 300, eee Retained Earnings 299, eee Total Liabilities and Owners' Equity $1,010, eea $ 75,000 111, eee 360,000 100,00 650,000 (230,000) $1,266,eee $ 105,eee 250,000 38,00 300,eee 373,80 $1,066,00 PLANET COMPANY AND SUBSIDIARY Consolidated Income Statement Year Ended December 31, 20x6 Sales Gain on Sale of Equipment Cost of Goods Sold Depreciation Expense Other Expenses Total Expenses Consolidated Net Income Income to Noncontrolling Interest Income to Controlling Interest $1,078, 280 30, e $1,100,000 $ $ 750,000 40,000 150, eee $ (940,000) $ 160,000 (12,eee) $ 148,000 PLANET COMPANY AND SUBSIDIARY Consolidated Retained Earnings Statement Year Ended December 31, 20x6 Balance, January 1, 20x6 $299, eee Income to Controlling Interest 148,000 $438,000 Dividends Declared, 20x6 (65,880) Balance, December 31, 20X6 $373,eee During 20X6, Sun reported net Income of $60,000 and paid dividends of $20,000; Planet reported net income of $148,000 and pald dividends of $65,000. There were no Intercompany transfers during the period. Required: Prepare a worksheet for a consolidated statement of cash flows for 20x6 using the Indirect method of computing cash flows from operations. (Values in the first two columns (the "parent" and "subsidiary" balances) that are to be deducted should be indicated with a minus sign, while all values in the "Consolidation Entries" columns should be entered as positive values. For accounts where multiple adjusting entries are required, combine all debit entries Into one amount and enter this amount in the deblt column of the worksheet. Similarly, combine all credit entries Into one amount and enter this amount in the credit column of the worksheet.) PLANET COMPANY AND SUBSIDIARY Consolidated Cash Flow Worksheet Year Ended December 31, 20X6 Consolidation Entries Balance Debit Credit 1/1/X6 Item Balance 12/31/X6 Assets Cash Accounts receivable Inventory Land Buildings and equipment Less: Accumulated depreciation Total Assets Liabilities & Equity Accounts payable Bonds payable Common stock Retained earnings Noncontrolling interest Total Liabilities & Equity Cash Flows from Operating Activities: Consolidated net income Depreciation expense Gain on sale of equipment Decrease in accounts receivable Increase in inventory Increase in accounts payable Cash Flows from Investing Activities: Sale of buildings and equipment Purchase of land Cash Flows from Financing Activities: Bond retirement Dividends Paid: To Planet Company shareholders To noncontrolling shareholders Increase in cash

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts