Question: eBook Do the Math 6-3 A Recent Graduate's Debt Status Chelsea Menken, of Providence, Rhode Island, recently graduated with a degree in food science and

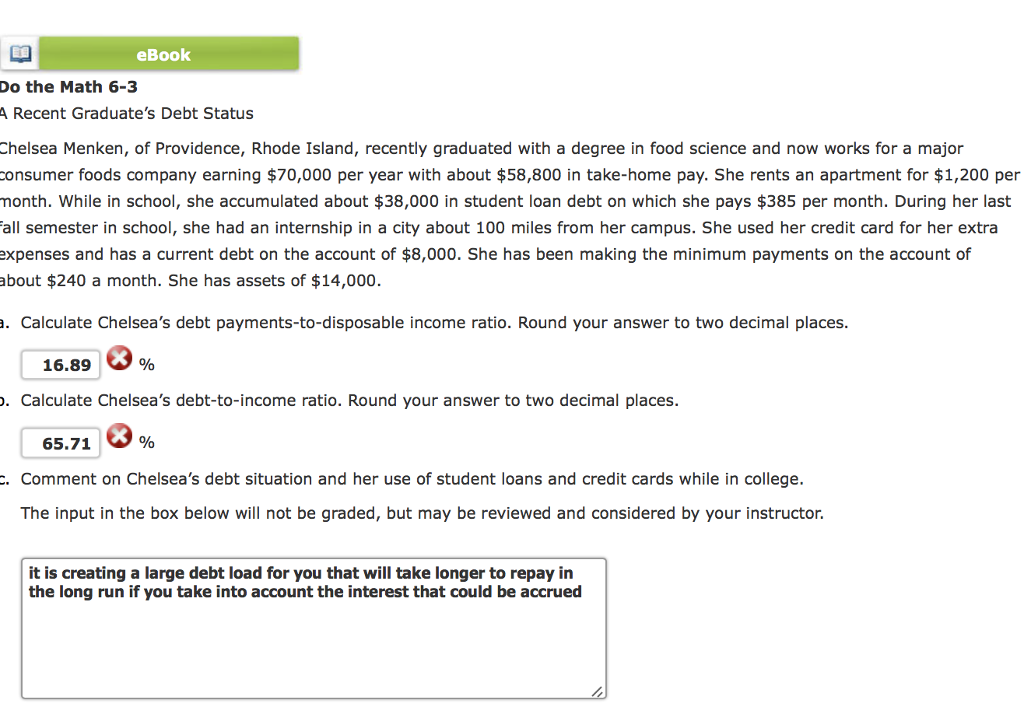

eBook Do the Math 6-3 A Recent Graduate's Debt Status Chelsea Menken, of Providence, Rhode Island, recently graduated with a degree in food science and now works for a major consumer foods company earning $70,000 per year with about $58,800 in take-home pay. She rents an apartment for $1,200 per month. While in school, she accumulated about $38,000 in student loan debt on which she pays $385 per month. During her last Fall semester in school, she had an internship in a city about 100 miles from her campus. She used her credit card for her extra expenses and has a current debt on the account of $8,000. She has been making the minimum payments on the account of about $240 a month. She has assets of $14,000. a. Calculate Chelsea's debt payments-to-disposable income ratio. Round your answer to two decimal places. 16.89 8 % . Calculate Chelsea's debt-to-income ratio. Round your answer to two decimal places. 65.71 65.71 % . Comment on Chelsea's debt situation and her use of student loans and credit cards while in college. The input in the box below will not be graded, but may be reviewed and considered by your instructor. it is creating a large debt load for you that will take longer to repay in the long run if you take into account the interest that could be accrued

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts