Question: eBook Optimal Capital Structure with Hamada Beckman Engineering and Associates (BEA) is considering a change in its capital structure. BEA currently has $20 million in

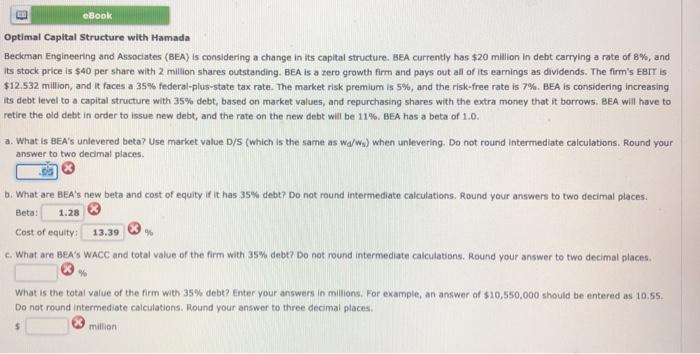

eBook Optimal Capital Structure with Hamada Beckman Engineering and Associates (BEA) is considering a change in its capital structure. BEA currently has $20 million in debt carrying a rate of 8%, and Its stock price is $40 per share with 2 million shares outstanding. BEA is a zero growth firm and pays out all of its earnings as dividends. The firm's EBIT IS $12.532 million, and it faces a 35% federal-plus-state tax rate. The market risk premium is 5%, and the risk-free rate is 7%. BEA is considering increasing its debt level to a capital structure with 35% debt, based on market values, and repurchasing shares with the extra money that it borrows. BEA will have to retiret e the old debt in order to issue new debt, and the rate on the new debt will be 11%. BEA has a beta of 1.0. a. What is BEA's unlevered beta? Use market value D/s (which is the same as wa/ww) when unlevering. Do not round Intermediate calculations. Round your answer to two decimal places. b. What are BEA's new beta and cost of equity if it has 35% debt? Do not round Intermediate calculations. Round your answers to two decimal places Beta: 1.28 13.39 96 Cost of equity c. What are Bea's WACC and total value of the firm with 35% debt? Do not round Intermediate calculations. Round your answer to two decimal places % What is the total value of the firm with 35% debt? Enter your answers in millions. For example, an answer of $10,550,000 should be entered as 10.5. Do not round intermediate calculations. Round your answer to three decimal places million

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts