Question: eBook Print Item Calculating Departmental Overhead Rates Using Post - Allocation Costs Chekov Company has two support departments, Human Resources and General Factory, and two

eBook

Print Item

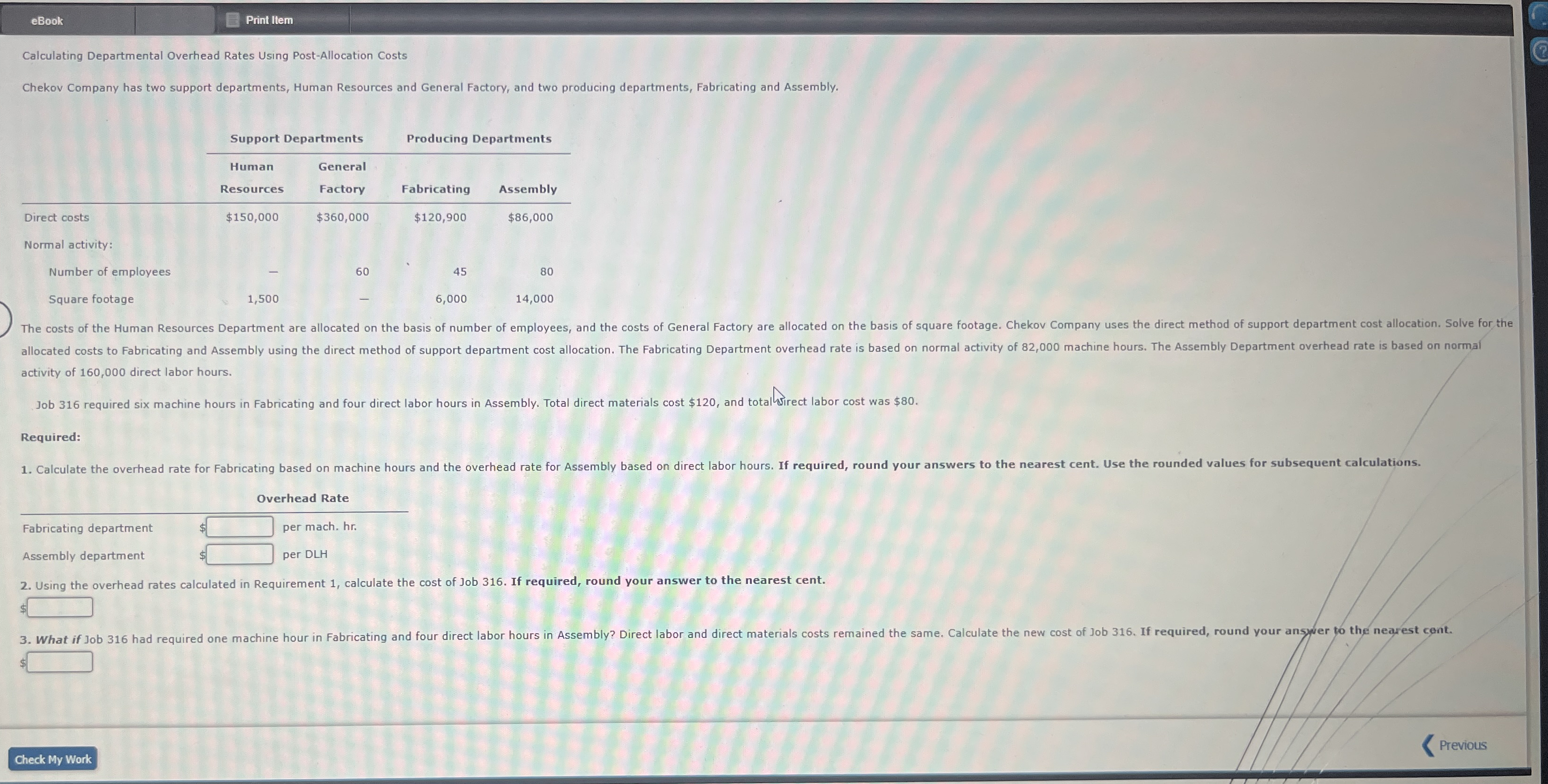

Calculating Departmental Overhead Rates Using PostAllocation Costs

Chekov Company has two support departments, Human Resources and General Factory, and two producing departments, Fabricating and Assembly.

tableSupport Departments,Producing DepartmentstableHumanResourcestableGeneralFactoryFabricating,AssemblyDirect costs,$$$$Normal activity:,,,,Number of employees,Square footage,

activity of direct labor hours.

Job required six machine hours in Fabricating and four direct labor hours in Assembly. Total direct materials cost $ and totallyirect labor cost was $

Required:

Overhead Rate

tableFabricating department,$per mach. hrAssembly department,$per DLH

Using the overhead rates calculated in Requirement calculate the cost of Job If required, round your answer to the nearest cent.

Previous

Step by Step Solution

There are 3 Steps involved in it

1 Expert Approved Answer

Step: 1 Unlock

Question Has Been Solved by an Expert!

Get step-by-step solutions from verified subject matter experts

Step: 2 Unlock

Step: 3 Unlock