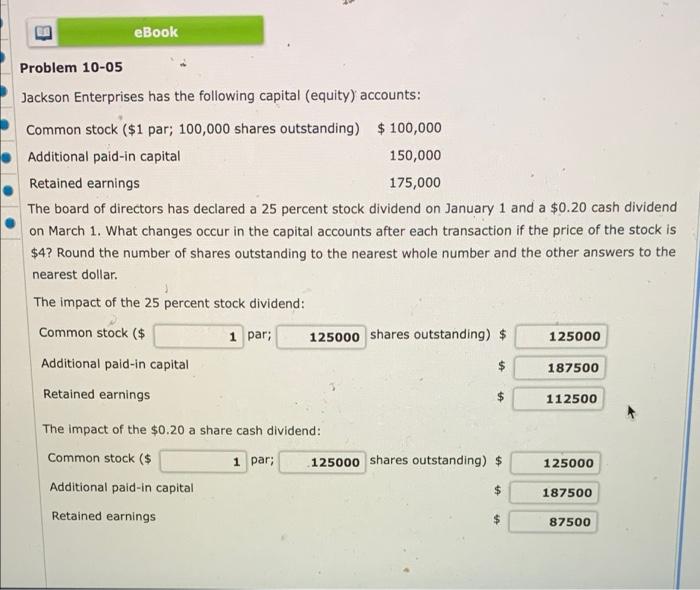

Question: eBook Problem 10-05 Jackson Enterprises has the following capital (equity) accounts: Common stock ($1 par; 100,000 shares outstanding) $ 100,000 Additional paid-in capital 150,000 Retained

eBook Problem 10-05 Jackson Enterprises has the following capital (equity) accounts: Common stock ($1 par; 100,000 shares outstanding) $ 100,000 Additional paid-in capital 150,000 Retained earnings 175,000 The board of directors has declared a 25 percent stock dividend on January 1 and a $0.20 cash dividend on March 1. What changes occur in the capital accounts after each transaction if the price of the stock is $4? Round the number of shares outstanding to the nearest whole number and the other answers to the nearest dollar The impact of the 25 percent stock dividend: Common stock ($ 1 par; 125000 shares outstanding) $ 125000 Additional paid-in capital $ Retained earnings 112500 187500 $ The impact of the $0.20 a share cash dividend: Common stock ($ 1 par; 125000 shares outstanding) $ Additional paid-in capital 125000 $ 187500 Retained earnings 87500

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts