Question: eBook Problem 14-04 You are considering purchasing the preferred stock of a firm but are concerned about its capacity to pay the dividend. To help

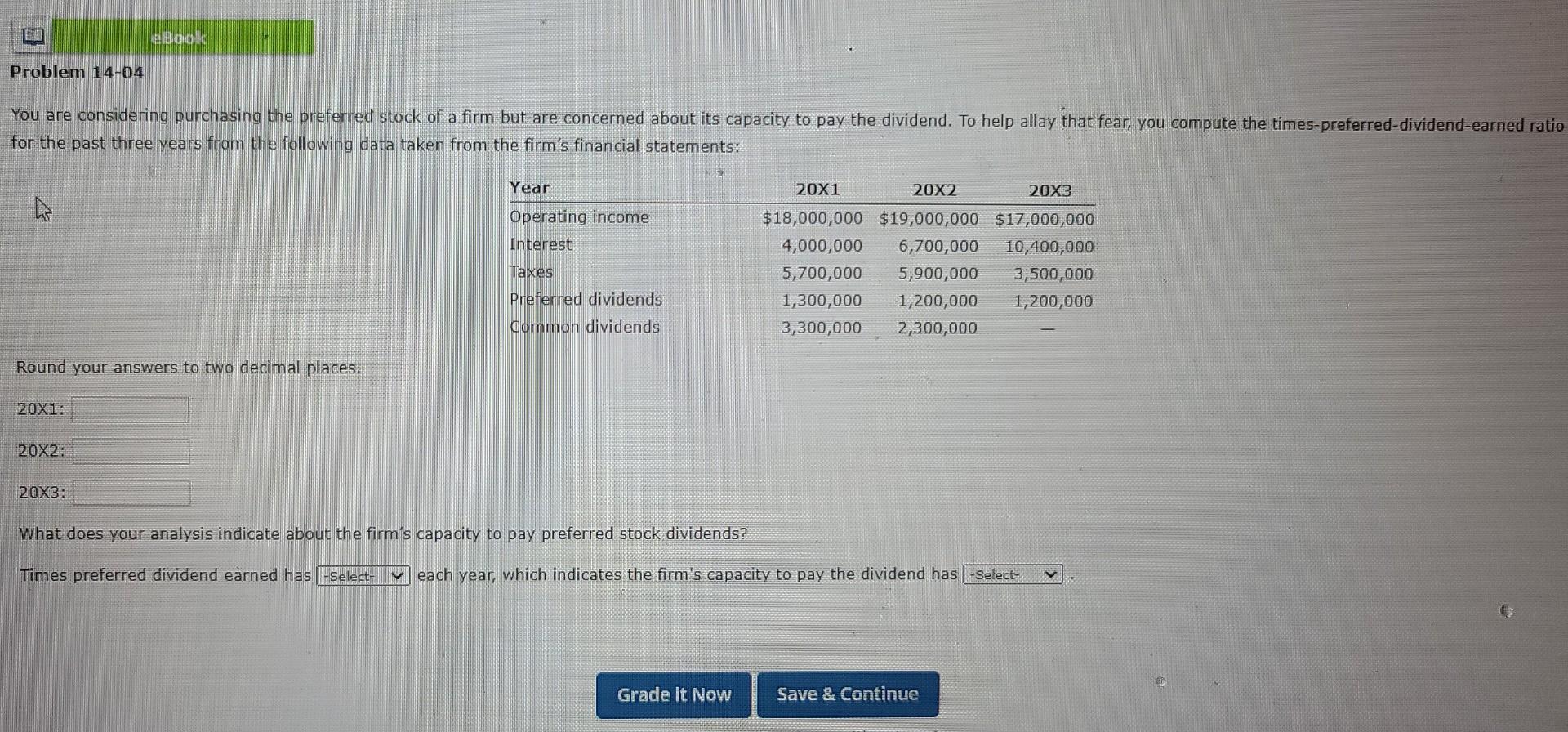

eBook Problem 14-04 You are considering purchasing the preferred stock of a firm but are concerned about its capacity to pay the dividend. To help allay that fear, you compute the times-preferred-dividend-earned ratio for the past three years from the following data taken from the firm's financial statements: Year 20X1 20X3 D 20X2 $18,000,000 $19,000,000 $17,000,000 Operating income Interest Taxes 4,000,000 6,700,000 10,400,000 5,700,000 5,900,000 3,500,000 1,300,000 1,200,000 1,200,000 3,300,000 2,300,000 Preferred dividends Common dividends Round your answers to two decimal places. 20X1: 20X2: 20X3: What does your analysis indicate about the firm's capacity to pay preferred stock dividends? Times preferred dividend earned has -Select- each year, which indicates the firm's capacity to pay the dividend has -Select- Grade it Now Save & Continue

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts