Question: eBook Problem Walk - Through Susan and Stan Britton are a married couple who file a joint income tax return, where the tax rates are

eBook Problem WalkThrough

Susan and Stan Britton are a married couple who file a joint income tax return, where the tax rates are based on the tax table Assume that their taxable income this year was $ Do not round intermediate calculation.

What is their federal tax liability? Round your answer to the nearest dollar.

$

What is their marginal tax rate? Round your answer to the nearest whole number.

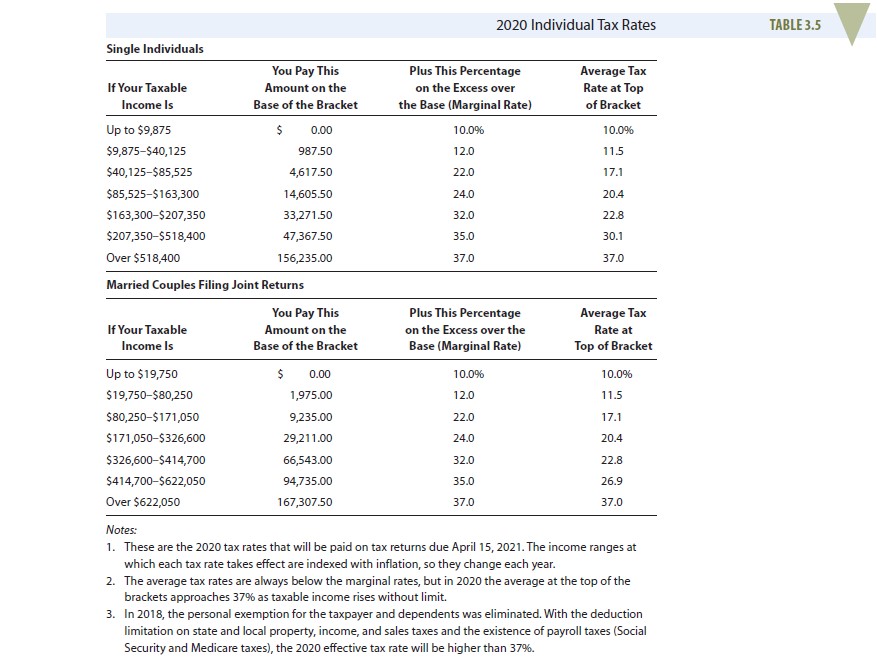

Single Individuals

Married Couples Filing Joint Returns

Notes:

These are the tax rates that will be paid on tax returns due April The income ranges at

which each tax rate takes effect are indexed with inflation, so they change each year.

The average tax rates are always below the marginal rates, but in the average at the top of the

brackets approaches as taxable income rises without limit

In the personal exemption for the taxpayer and dependents was eliminated. With the deduction

limitation on state and local property, income, and sales taxes and the existence of payroll taxes Social

Security and Medicare taxes the effective tax rate will be higher than

What is their average tax rate? Round your answer to two decimal places.

Step by Step Solution

There are 3 Steps involved in it

1 Expert Approved Answer

Step: 1 Unlock

Question Has Been Solved by an Expert!

Get step-by-step solutions from verified subject matter experts

Step: 2 Unlock

Step: 3 Unlock