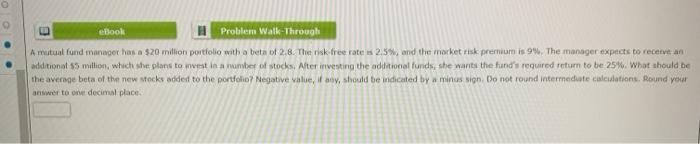

Question: ebook Problem Walk-Through A mutual fund manager has a $20 million portfolio with a beta of 2.8. The risk free rates 2.5%, and the market

ebook Problem Walk-Through A mutual fund manager has a $20 million portfolio with a beta of 2.8. The risk free rates 2.5%, and the market tisk premium is 99. The manager expects to receive an additional $5 million, which she plans to uvest in a number of stocks. After investing the additional funds, she wants the fund's required return to be 25%. What should be the average beta of the new stocks added to the portfolio Negative value, if any, should be indicated by a minussion. Do not found intermediate calculations. Round your answer to one decimal place

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts