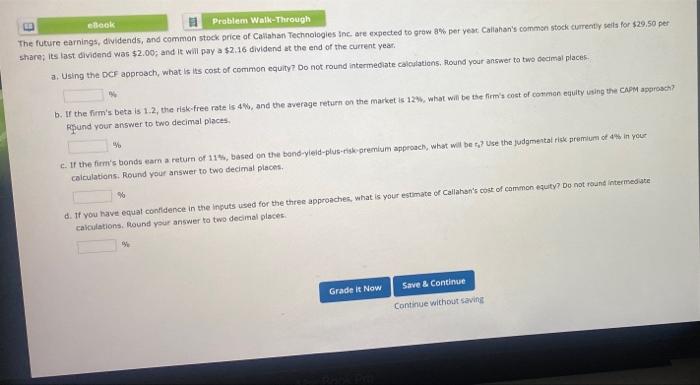

Question: eBook Problem Walk-Through The future earnings, dividends, and common stock price of Callahan Technologies Inc. are expected to grow 8% per year Callahan's common stock

eBook Problem Walk-Through The future earnings, dividends, and common stock price of Callahan Technologies Inc. are expected to grow 8% per year Callahan's common stock currently sells for $29.50 per share; its last dividend was $2.00, and it will pay a $2.16 dividend at the end of the current year. a. Using the DCF approach, what is its cost of common equity? Do not round intermediate calculations. Round your answer to two decimal places b. If the firm's beta is 1.2, the risk-free rate is 4, and the average return on the market is 129 what will be the firm's cost of common equity using the CAPM approach? Rund your answer to two decimal places c. If the firm's bonds earn a return of 114, based on the bond-yield-plus-risk premium approach, what will be re? Use the judgmental risk premium of 4% in your calculations. Round your answer to two decimal places d. If you have equat confidence in the inputs used for the three approaches, what is your estimate of Callahan's cost of common gut? Do not found intermediate calculations. Round your answer to two decimal places 9 Save & Continue Grade it Now Continue without saving

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts