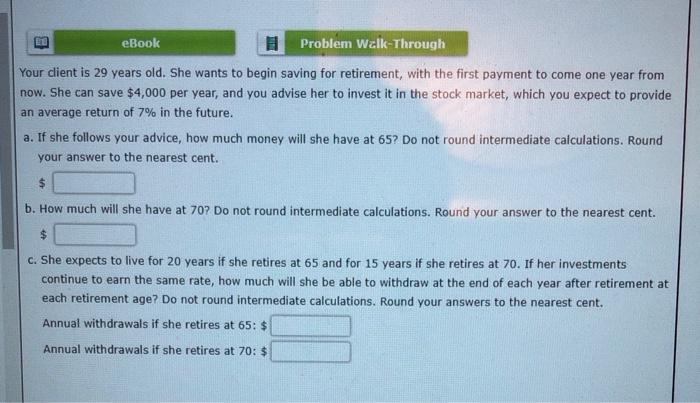

Question: eBook Problem Walk-Through Your client is 29 years old. She wants to begin saving for retirement, with the first payment to come one year from

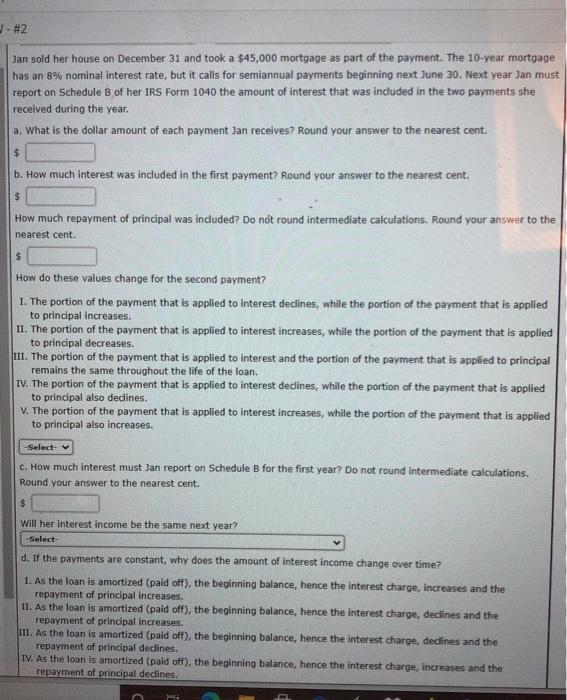

eBook Problem Walk-Through Your client is 29 years old. She wants to begin saving for retirement, with the first payment to come one year from now. She can save $4,000 per year, and you advise her to invest it in the stock market, which you expect to provide an average return of 7% in the future. a. If she follows your advice, how much money will she have at 65? Do not round intermediate calculations. Round your answer to the nearest cent. $ b. How much will she have at 707 Do not round intermediate calculations. Round your answer to the nearest cent. $ c. She expects to live for 20 years if she retires at 65 and for 15 years if she retires at 70. If her investments continue to earn the same rate, how much will she be able to withdraw at the end of each year after retirement at each retirement age? Do not round intermediate calculations. Round your answers to the nearest cent. Annual withdrawals if she retires at 65: $ Annual withdrawals if she retires at 70: $ 1 #2 Jan sold her house on December 31 and took a $45,000 mortgage as part of the payment. The 10-year mortgage has an 8% nominal interest rate, but it calls for semiannual payments beginning next June 30. Next year Jan must report on Schedule 8 of her IRS Form 1040 the amount of interest that was induded in the two payments she received during the year. a. What is the dollar amount of each payment Jan receives? Round your answer to the nearest cent. $ b. How much interest was included in the first payment? Round your answer to the nearest cent. $ How much repayment of principal was induded? Do not round intermediate calculations. Round your answer to the nearest cent. $ How do these values change for the second payment? 1. The portion of the payment that is applied to interest declines, while the portion of the payment that is applied to principal increases. 11. The portion of the payment that is applied to interest increases, while the portion of the payment that is applied to principal decreases. III. The portion of the payment that is applied to interest and the portion of the payment that is applied to principal remains the same throughout the life of the loan. IV. The portion of the payment that is applied to interest declines, while the portion of the payment that is applied to principal also declines. V. The portion of the payment that is applied to interest increases, while the portion of the payment that is applied to principal also increases. -Select- c. How much interest must Jan report on Schedule B for the first year? Do not round Intermediate calculations. Round your answer to the nearest cent. $ will her interest income be the same next year? -Select- d. If the payments are constant, why does the amount of Interest income change over time? 1. As the loan is amortized (paid off), the beginning balance, hence the interest charge, increases and the repayment of principal increases. 11. As the loan is amortized (paid off), the beginning balance, hence the interest charge, declines and the repayment of principal increases. IT. As the loan is amortized (paid off), the beginning balance, hence the interest charge, declines and the repayment of principal declines. IV. As the loan is amortized (paid off), the beginning balance, hence the interest charge, increases and the repayment of principal declines

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts