Question: eBook Question Content Area Notes and Interest Glencoe Inc. operates with a June 30 year-end. During 2017, the following transactions occurred: January 1: Signed a

eBook

Question Content Area

Notes and Interest

Glencoe Inc. operates with a June 30 year-end. During 2017, the following transactions occurred:

- January 1: Signed a one-year, 10% loan for $25,000. Interest and principal are to be paid at maturity.

- January 10: Signed a line of credit with Little Local Bank to establish a $400,000 line of credit. Interest of 9% will be charged on all borrowed funds.

- February 1: Issued a $20,000 non-interest-bearing, six-month note to pay for a new machine. Interest on the note, at 12%, was deducted in advance.

- March 1: Borrowed $150,000 on the line of credit.

- June 1: Repaid $100,000 on the line of credit plus accrued interest.

- June 30: Made all necessary adjusting entries.

- August 1: Repaid the non-interest-bearing note.

- September 1: Borrowed $200,000 on the line of credit.

- November 1: Issued a three-month, 8%, $12,000 note in payment of an overdue open account.

- December 31: Repaid the one-year loan [from transaction (a)] plus accrued interest.

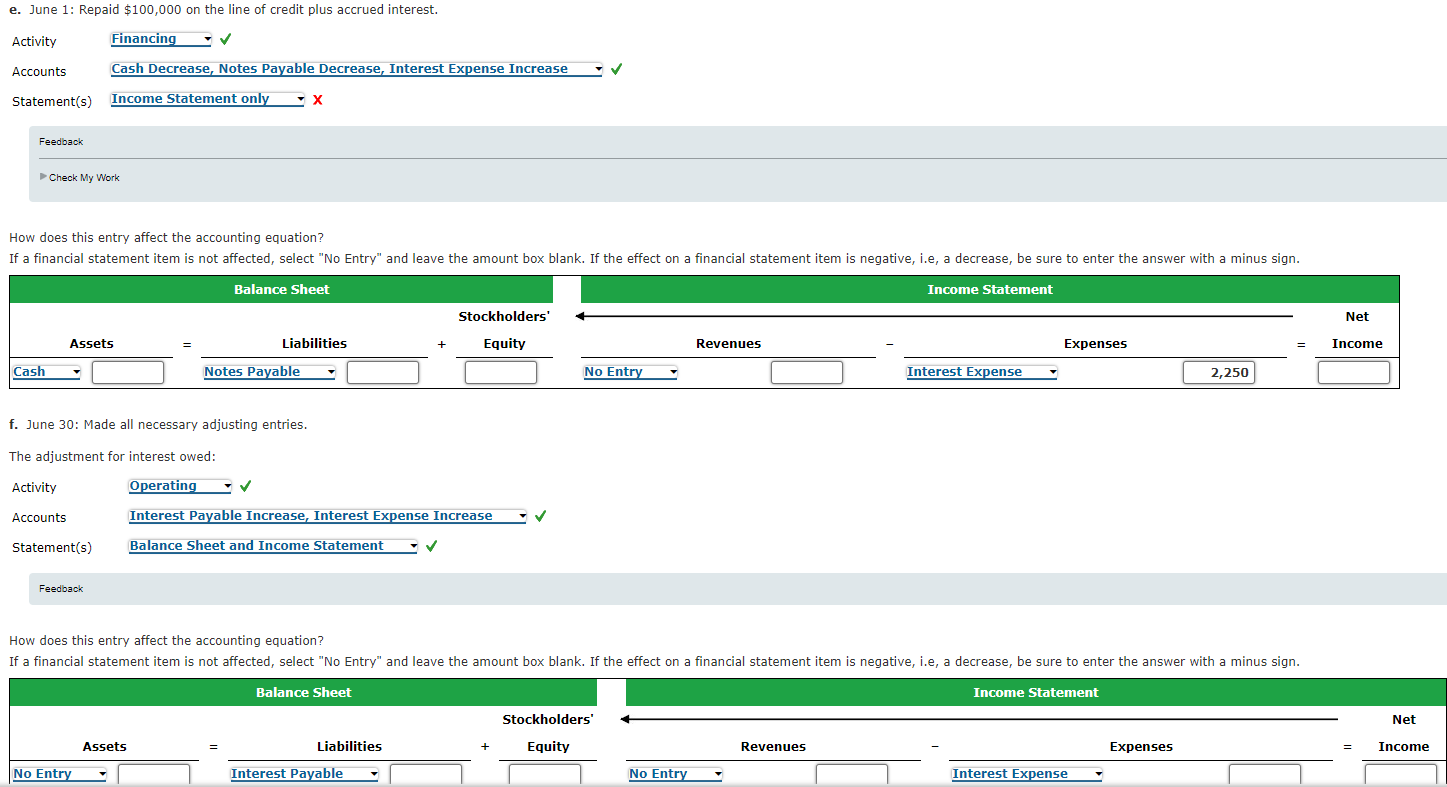

e. June 1: Repaid $100,000 on the line of credit plus accrued interest. Activity Financing Accounts Cash Decrease, Notes Payable Decrease, Interest Expense Increase Statement(s) Income Statement only X Feedback Check My Work How does this entry affect the accounting equation? If a financial statement item is not affected, select "No Entry" and leave the amount box blank. If the effect on a financial statement item is negative, i.e, a decrease, be sure to enter the answer with a minus sign. Balance Sheet Income Statement Stockholders' Net Assets Liabilities + Equity Revenues Expenses Income Cash Notes Payable No Entry Interest Expense 2,250 f. June 30: Made all necessary adjusting entries. The adjustment for interest owed: Activity Operating Accounts Interest Payable Increase, Interest Expense Increase Statement(s) Balance Sheet and Income Statement Feedback How does this entry affect the accounting equation? If a financial statement item is not affected, select "No Entry" and leave the amount box blank. If the effect on a financial statement item is negative, i.e, a decrease, be sure to enter the answer with a minus sign. Balance Sheet Income Statement Stockholders Net Assets Liabilities Equity Revenues Expenses Income No Entry Interest Payable No Entry Interest Expense

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts