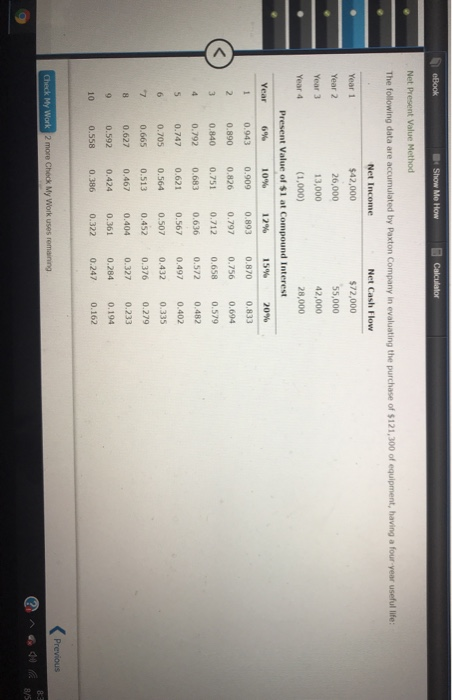

Question: eBook Show Me How Calculator Net Present Value Method The following data are accumulated by Paxton Company in evaluating the purchase of $121,300 of equipment,

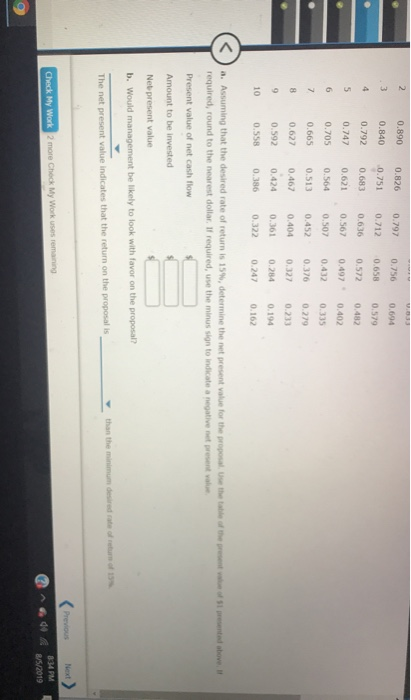

eBook Show Me How Calculator Net Present Value Method The following data are accumulated by Paxton Company in evaluating the purchase of $121,300 of equipment, having a four year useful life: Net Income Net Cash Flow Year 1 $42,000 $72,000 Year 2 26,000 55,000 Year 3 13,000 42,000 Year 4 (1,000) 28,000 Present Value of $1 at Compound Interest Year 6% 10% 12% 15% 20% 0.943 0.909 0.893 0.870 0.833 0.890 0.826 0.797 0.756 0.694 0.840 0.751 0.712 0.658 0.579 0.792 0.683 0.636 0.572 0.482 0.747 0.621 0.567 0.497 0.402 0.705 0.564 0.507 0.432 0.335 0.665 0.513 0.452 0.376 0.279 0.627 0.467 0.404 0.327 0.233 0.592 0.424 0.361 0.284 0.194 0.558 0.386 0.322 0.247 0.162 Previous Check My Work 2 more Check My Work uses remaining 0.756 0.890 0.840 0.792 0.747 0.705 0.665 0.627 0.592 0.558 0.826 0.751 0.683 0.621 0.564 0.513 0.467 0.572 0.497 0.797 0.712 0.636 0.567 0.507 0.452 0.404 0.161 0.322 0.432 0.579 0.482 0.402 0.335 0.279 0.233 0.194 0.162 0.376 0.327 0.234 0.247 0.624 0.16 required, round to the nearest dollar. If required, use the minus in townicate Present value of net cash low Amount to be invested Netent value b. Would management be likely to look with favor on the proposal The net present Value indicates that there on the proposal Check My Work 2 more Check My Work uses remaining Previous Next > A BHM 3522019

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts