Question: eBook Show Me How Office 365 Net present value method The following data are accumulated by Geddes Company in evaluating the purchase of $140,000 of

-

eBook

Show Me How

Office 365

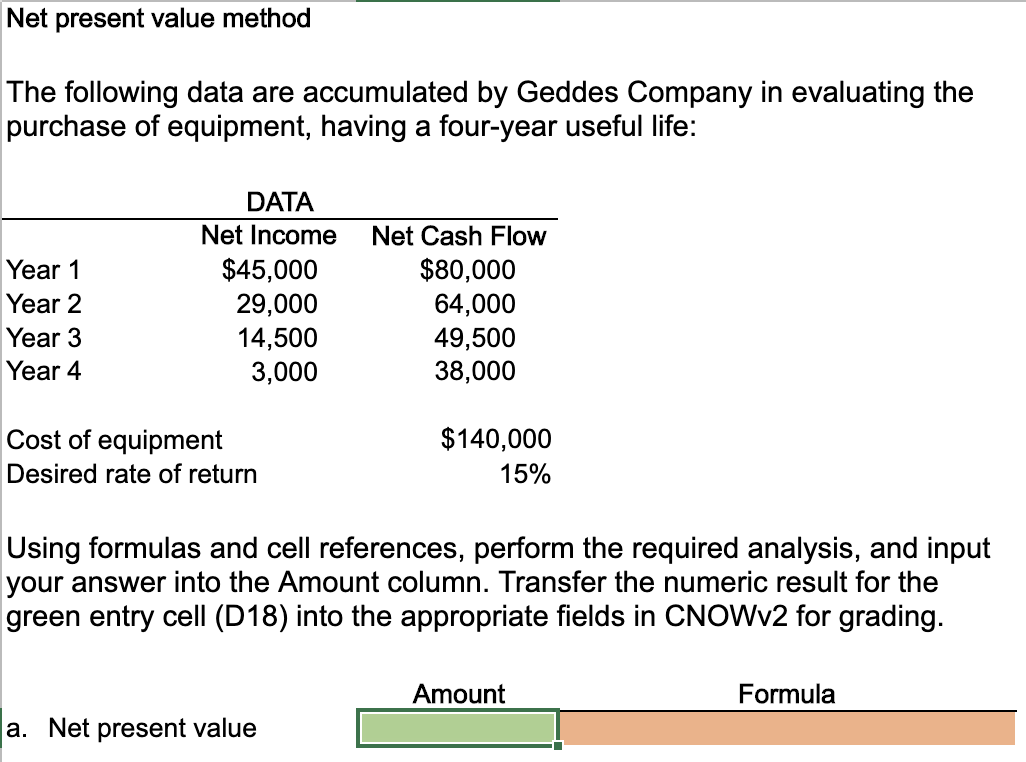

Net present value method

The following data are accumulated by Geddes Company in evaluating the purchase of $140,000 of equipment, having a four-year useful life:

Net Income Net Cash Flow Year 1 $45,000 $80,000 Year 2 29,000 64,000 Year 3 14,500 49,500 Year 4 3,000 38,000 This information has been collected in the Microsoft Excel Online file. Open the spreadsheet, perform the required analysis, and input your answers in the questions below.

Open spreadsheet

- Assuming that the desired rate of return is 15%, determine the net present value for the proposal. If required, round to the nearest dollar.

Net present value $fill in the blank 2 - Would management be likely to look with favor on the proposal?

YesNo

, the net present value indicates that the return on the proposal isgreaterless

than the minimum desired rate of return of 15%.

- Assuming that the desired rate of return is 15%, determine the net present value for the proposal. If required, round to the nearest dollar.

Net present value method The following data are accumulated by Geddes Company in evaluating the purchase of equipment, having a four-year useful life: Year 1 Year 2 Year 3 Year 4 DATA Net Income $45,000 29,000 14,500 3,000 Net Cash Flow $80,000 64,000 49,500 38,000 Cost of equipment Desired rate of return $140,000 15% Using formulas and cell references, perform the required analysis, and input your answer into the Amount column. Transfer the numeric result for the green entry cell (D18) into the appropriate fields in CNOWv2 for grading. Amount Formula a. Net present value

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts