Question: eBook Show Me How Question Content Area Backflush Costing: Variation 2 Potter Company has installed a JIT purchasing and manufacturing system and is using backflush

eBook

Show Me How

Question Content Area

Backflush Costing: Variation 2

Potter Company has installed a JIT purchasing and manufacturing system and is using backflush accounting for its cost flows. It currently uses a two-trigger approach with the purchase of materials as the first trigger point and the completion of goods as the second trigger point. During the month of June, Potter had the following transactions:

| Raw materials purchased | $242,000 |

| Direct labor cost | 41,000 |

| Overhead cost | 205,000 |

| Conversion cost applied | 266,500* |

*$41,000 labor plus $225,500 overhead.

There were no beginning or ending inventories. All goods produced were sold with a 60 percent markup. Any variance is closed to Cost of Goods Sold. (Variances are recognized monthly.)

Required:

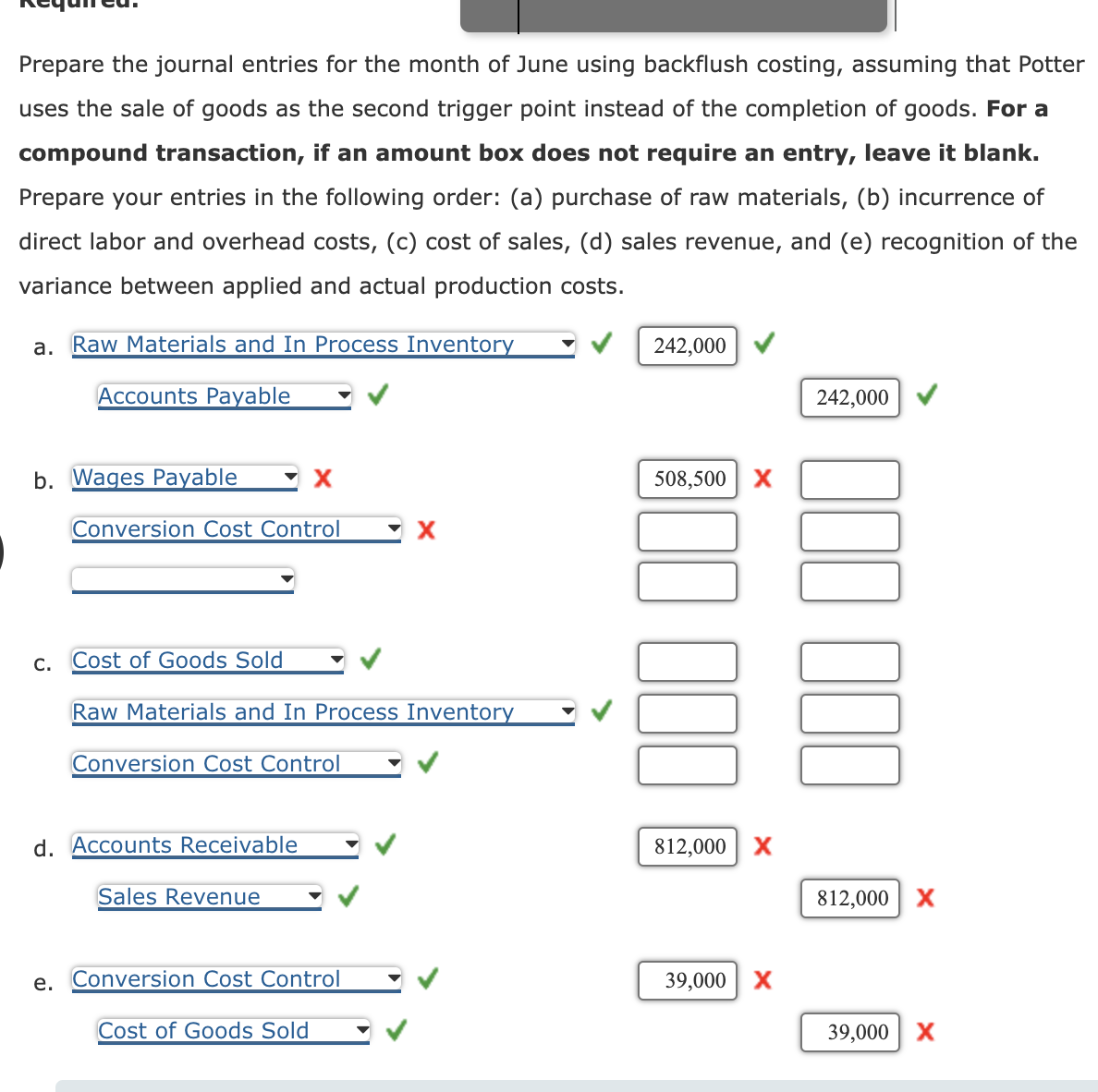

Prepare the journal entries for the month of June using backflush costing, assuming that Potter uses the sale of goods as the second trigger point instead of the completion of goods. For a compound transaction, if an amount box does not require an entry, leave it blank. Prepare the entries in the following order: (a) purchase of raw materials, (b) incurrence of direct labor and overhead costs, (c) cost of sales, (d) sales revenue, and (e) recognition of the variance between applied and actual production costs.

| a. | Accounts PayableAccounts ReceivableConversion Cost ControlCost of Goods SoldRaw Materials and In Process InventorySales RevenueWages Payable | - Select - | |

| Accounts PayableAccounts ReceivableConversion Cost ControlCost of Goods SoldRaw Materials and In Process InventorySales RevenueWages Payable | - Select - | ||

| b. | Accounts PayableAccounts ReceivableConversion Cost ControlCost of Goods SoldRaw Materials and In Process InventorySales RevenueWages Payable | - Select - | - Select - |

| Accounts PayableAccounts ReceivableConversion Cost ControlCost of Goods SoldRaw Materials and In Process InventorySales Revenue | - Select - | - Select - | |

| Accounts ReceivableConversion Cost ControlCost of Goods SoldRaw Materials and In Process InventorySales RevenueWages Payable | - Select - | - Select - | |

| c. | Accounts PayableAccounts ReceivableConversion Cost ControlCost of Goods SoldRaw Materials and In Process InventorySales RevenueWages Payable | - Select - | - Select - |

| Accounts PayableCashCost of Goods SoldFinished Goods InventoryRaw Materials and In Process Inventory | - Select - | - Select - | |

| Accounts PayableCashConversion Cost ControlCost of Goods SoldFinished Goods Inventory | - Select - | - Select - | |

| d. | Accounts PayableAccounts ReceivableConversion Cost ControlCost of Goods SoldRaw Materials and In Process InventorySales RevenueWages Payable | - - | |

| Accounts PayableAccounts ReceivableConversion Cost ControlCost of Goods SoldRaw Materials and In Process InventorySales RevenueWages Payable | - Select - | ||

| e. | Accounts PayableAccounts ReceivableConversion Cost ControlCost of Goods SoldRaw Materials and In Process InventorySales RevenueWages Payable | - Select - | |

| Accounts PayableAccounts ReceivableConversion Cost ControlCost of Goods SoldRaw Materials and In Process InventorySales RevenueWages Payable | - Select - |

Prepare the journal entries for the month of June using backflush costing, assuming that Potter uses the sale of goods as the second trigger point instead of the completion of goods. For a compound transaction, if an amount box does not require an entry, leave it blank. Prepare your entries in the following order: (a) purchase of raw materials, (b) incurrence of direct labor and overhead costs, (c) cost of sales, (d) sales revenue, and (e) recognition of the variance between applied and actual production costs. a. Raw Materials and In Process Inventory 242,000 Accounts Payable 242,000 b. Wages Payable X 508,500 X Conversion Cost Control X c. Cost of Goods Sold Raw Materials and In Process Inventory Conversion Cost Control d. Accounts Receivable 812,000 X Sales Revenue 812,000 X e. Conversion Cost Control 39,000 X Cost of Goods Sold V 39,000 X

Prepare the journal entries for the month of June using backflush costing, assuming that Potter uses the sale of goods as the second trigger point instead of the completion of goods. For a compound transaction, if an amount box does not require an entry, leave it blank. Prepare your entries in the following order: (a) purchase of raw materials, (b) incurrence of direct labor and overhead costs, (c) cost of sales, (d) sales revenue, and (e) recognition of the variance between applied and actual production costs. a. Raw Materials and In Process Inventory 242,000 Accounts Payable 242,000 b. Wages Payable X 508,500 X Conversion Cost Control X c. Cost of Goods Sold Raw Materials and In Process Inventory Conversion Cost Control d. Accounts Receivable 812,000 X Sales Revenue 812,000 X e. Conversion Cost Control 39,000 X Cost of Goods Sold V 39,000 X

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts