Question: eBook Video Calculator Problem 3-36 (LO. 1, 2, 3, 4, 5, 6) Charlotte (age 40) is a surviving spouse and provides all of the support

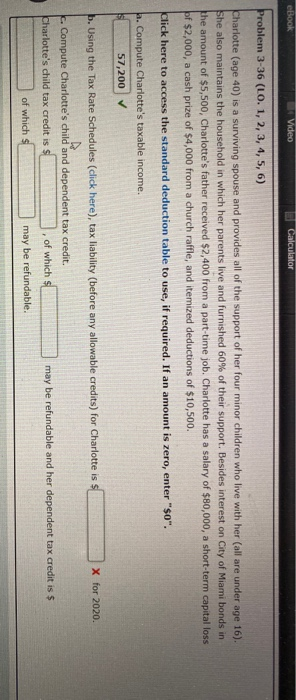

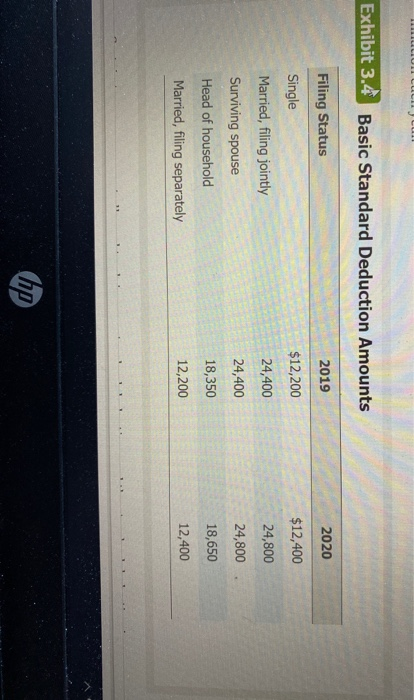

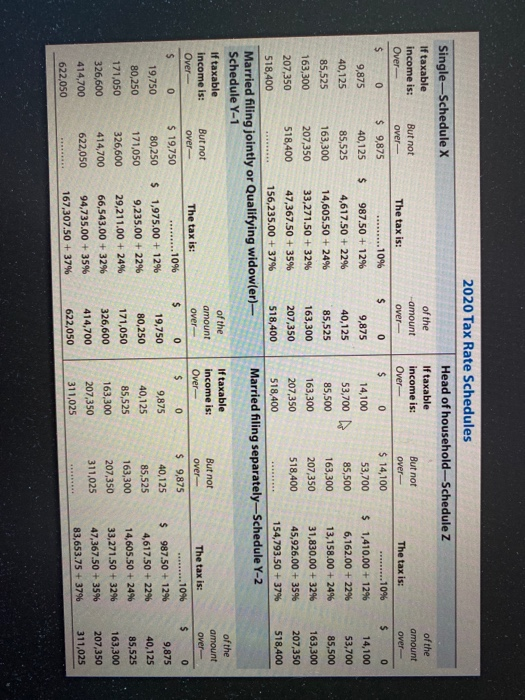

eBook Video Calculator Problem 3-36 (LO. 1, 2, 3, 4, 5, 6) Charlotte (age 40) is a surviving spouse and provides all of the support of her four minor children who live with her (all are under age 16). She also maintains the household in which her parents live and furnished 60% of their support. Besides interest on City of Miami bonds in the amount of $5,500, Charlotte's father received $2,400 from a part-time job. Charlotte has a salary of $80,000, a short-term capital loss pf $2,000, a cash prize of $4,000 from a church raffle, and itemized deductions of $10,500. Click here to access the standard deduction table to use, if required. If an amount is zero, enter"$0". la. Compute Charlotte's taxable income. 57,200 . Using the Tax Rate Schedules (click here), tax liability (before any allowable credits) for Charlotte is $ X for 2020. 1. Compute Charlotte's child and dependent tax credit. Charlotte's child tax credit is S of which $ may be refundable and her dependent tax credit is $ of which s may be refundable. Exhibit 3.4 Basic Standard Deduction Amounts Filing Status 2019 2020 Single $12,200 $12,400 Married, filing jointly 24,400 24,800 24,400 24,800 Surviving spouse Head of household Married, filing separately 18,350 18,650 12,200 12,400 hp of the amount over $ 0 14,100 53,700 85,500 163,300 207,350 518,400 2020 Tax Rate Schedules Single-Schedule X Head of household-Schedule Z If taxable of the If taxable income is: But not - amount income is: But not Over- over- The tax is: over Over- over- The tax is: $ 0 $ 9,875 ...1096 $ 0 $ 0 $ 14,100 .........10 9,875 40,125 $ 987.50 + 12% 9,875 14,100 53,700 $ 1,410.00+ 12% 40,125 85,525 4,617.50 + 22% 40,125 53,700 85,500 6,162.00 + 22% 85,525 163,300 14,605.50 +24% 85,525 85,500 163,300 13,158.00 + 24% 163,300 207,350 33,271.50 + 32% 163,300 163,300 207,350 31,830,00 + 3296 207,350 518,400 47,367.50 + 35% 207,350 207,350 518,400 45,926.00 + 35% 518,400 156,235.00 + 37% 518,400 518,400 154,793.50 +37% Married filing jointly or Qualifying widow(er) Married filing separately-Schedule Y-2 Schedule Y-1 If taxable of the If taxable income is: But not amount income is: But not Over The tax is: over- Over Over- Over- The tax is: $ 0 $ 19,750 .........10% $ 0 $ 0 $ 9,875 19,750 $ 1,975.00 + 12% 19,750 80,250 $ 9,875 40,125 987.50 + 12% 80,250 171,050 9,235.00 + 22% 80,250 40,125 85.525 4,617.50 + 22% 171,050 326,600 14,605.50 + 24% 171,050 29,211.00 + 24% 85,525 163,300 326,600 66,543.00 + 32% 326,600 414,700 207,350 163,300 33,271.50 + 32% 414,700 622,050 47,367.50 + 35% 414,700 94,735.00 + 35% 207,350 311,025 622,050 83,653.75 + 37% 622,050 167,307.50 + 37% 311,025 *** ... 10% of the amount over $ 0 9,875 40,125 85,525 163,300 207,350 311,025 ********* *****

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts