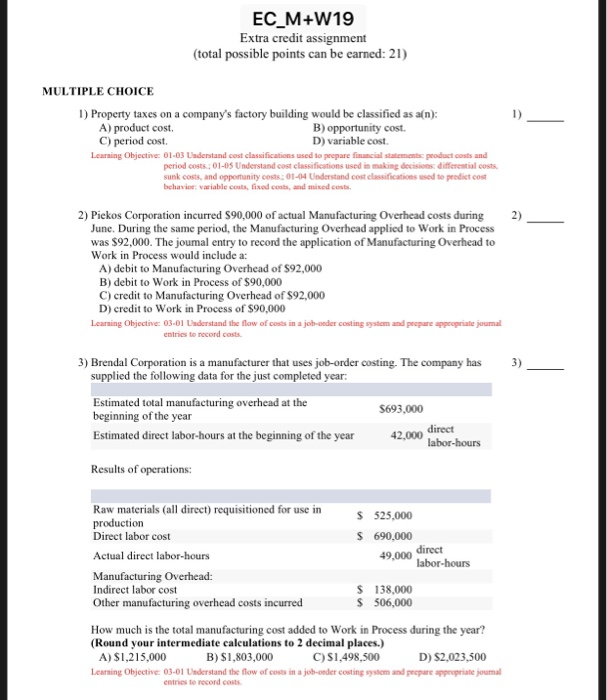

Question: EC M+W19 Extra credit assignment (total possible points can be earned: 21) MULTIPLE CHOICE 1) Property taxes on a company's factory building would be classified

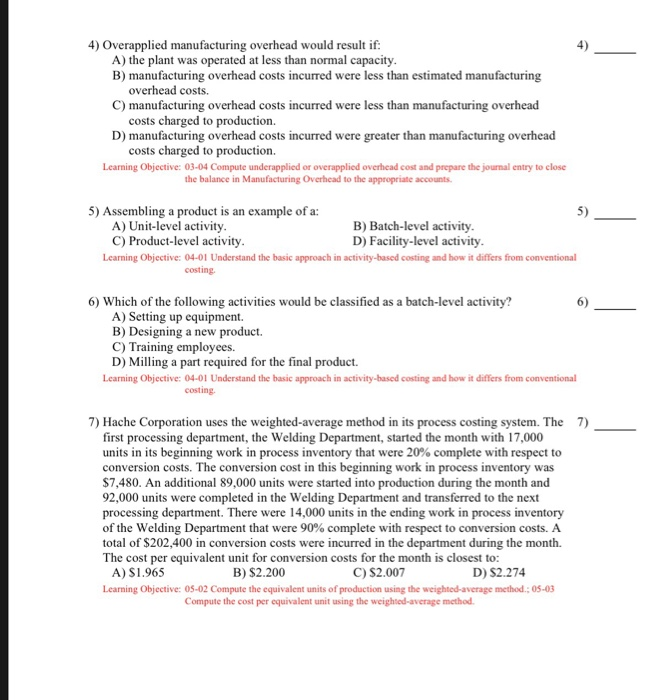

EC M+W19 Extra credit assignment (total possible points can be earned: 21) MULTIPLE CHOICE 1) Property taxes on a company's factory building would be classified as a(n) 1) A) product cost. B) opportunity cost. D) variable cost. cost. Learaing Objective 01-03 Uaderstand cest classifications used to prepare financial statements: product costs and period costs. : 01-05 Understand c0 classifications used in making decisions differential costs. sunk costs, and opportunity costs: 01-04 Understand cost elassifications used to predict cost bchavioe: variable costs, fixed conts, and mixed costs 2) Piekos Corporation incurred $90,000 of actual Manufacturing Overhead costs during 2) June. During the same period, the Manufacturing Overhead applied to Work in Process was $92,000. The joumal entry to record the application of Manufacturing Overhead to Work in Process would include a: A) debit to Manufacturing Overhead of $92,000 B) debit to Work in Process of $90,000 C) credit to Manufacturing Overhead of $92,000 D) credit to Work in Process of $90,000 Learaing Objective 03-01 Uaderstand the flow of costs in a job-ooder costing systcm and prepare appropriate journal entries to record costs 3) Brendal Corporation is a manufacturer that uses job-order costing. The company has 3) supplied the following data for the just completed year: Estimated total manufacturing overhead at the beginning of the year $693,000 Estimated direct labor-hours at the beginning of the year 42.000 labor-hours Results of operations: Raw materials (all direct) requisitioned for use in production Direct labor cost S 525,000 S 690,000 Actual direct labor-hours 49,000 direct Manufacturing Overhead Indirect labor cost S 138,000 S 506,000 Other manufacturing overhead costs incurred How much is the total manufacturing cost added to Work in Process during the year? (Round your intermediate calculations to 2 decimal places.) B) S1,803,000 A) $1,215,000 Learning Objective: 03-01 Understand the flow of costs in a job-onder costing system and prepare appropriate journal C)S1,498,500 D) $2,023,500 entries to record costs 4) Overapplied manufacturing overhead would result if 4) A) the plant was operated at less than normal capacity B) manufacturing overhead costs incurred were less than estimated manufacturing overhead costs. costs charged to production. costs charged to production. C) manufacturing overhead costs incurred were less than manufacturing overhead D) manufacturing overhead costs incurred were greater than manufacturing overhead Learning Objective: 03-04 Compute underapplied or overapplied overhead cost and prepare the journal entry to close the balance in Manufacturing Overhead to the appropriate accounts 5 Assembling a product is an example of a: 5) A) Unit-level activity C) Product-level activity B) Batch-level activity D) Facility-level activity Learning Objective: 04-01 Understand the basic approach in activity-based costing and how it differs from conventional costing 6) Which of the following activities would be classified as a batch-level activity? 6) A) Setting up equipment B) Designing a new product. C) Training employees. D) Milling a part required for the final product. Learning Objective: 04-01 Understand the basic approach in activity-based costing and how it differs from conventional costing. 7) Hache Corporation uses the weighted-average method in its process costing system. The 7) first processing department, the Welding Department, started the month with 17,000 units in its beginning work in process inventory that were 20% complete with respect to conversion costs. The conversion cost in this beginning work in process inventory was $7,480. An additional 89,000 units were started into production during the month and 92,000 units were completed in the Welding Department and transferred to the next processing department. There were 14,000 units in the ending work in process inventory of the Welding Department that were 90% complete with respect to conversion costs. A total of $202,400 in conversion costs were incurred in the department during the month. The cost per equivalent unit for conversion costs for the month is closest to: A) $ 1 .965 B) $2.200 C) S2.007 D) $2.274 Learning Objective: 05-02 Compute the equivalent units of production using the weighted-average method.; 05-03 Compute the cost per equivalent unit using the weighted-average method

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts