Question: EC-6 Computing Bond Issue Proceeds and Issue Price Your company plans to issue bonds later in the upcoming year. But with the economic uncertainty and

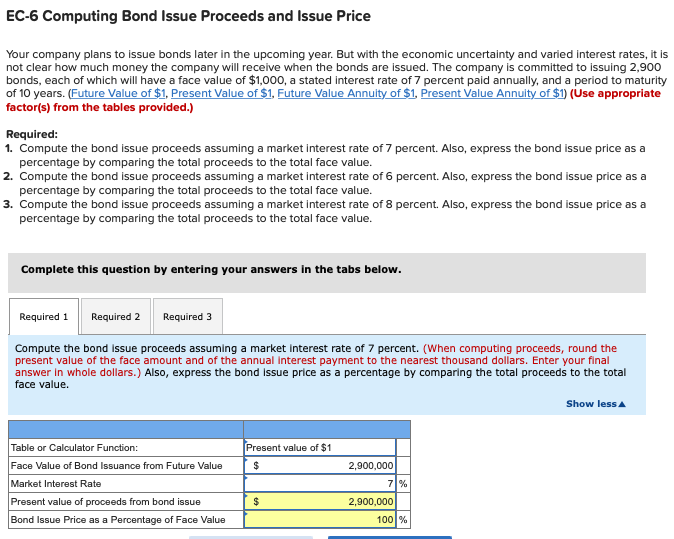

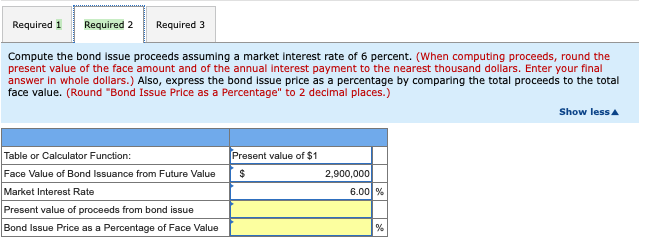

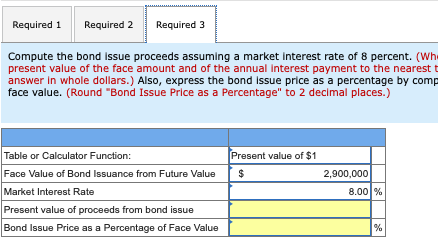

EC-6 Computing Bond Issue Proceeds and Issue Price Your company plans to issue bonds later in the upcoming year. But with the economic uncertainty and varied interest rates, it is not clear how much money the company will receive when the bonds are issued. The company is committed to issuing 2,900 bonds, each of which will have a face value of $1,000, a stated interest rate of 7 percent paid annually, and a period to maturity of 10 years. (Future Value of $1. Present Value of $1. Future Value Annuity of $1. Present Value Annuity of $1) (Use appropriate factor(s) from the tables provided.) Required: 1. Compute the bond issue proceeds assuming a market interest rate of 7 percent. Also, express the bond issue price as a percentage by comparing the total proceeds to the total face value. 2. Compute the bond issue proceeds assuming a market interest rate of 6 percent. Also, express the bond issue price as a percentage by comparing the total proceeds to the total face value. 3. Compute the bond issue proceeds assuming a market interest rate of 8 percent. Also, express the bond issue price as a percentage by comparing the total proceeds to the total face value. Complete this question by entering your answers in the tabs below. Required 1 Required 2 Required 3 Compute the bond issue proceeds assuming a market interest rate of 7 percent. (When computing proceeds, round the present value of the face amount and of the annual interest payment to the nearest thousand dollars. Enter your final answer in whole dollars.) Also, express the bond issue price as a percentage by comparing the total proceeds to the total face value. Show less Present value of $1 $ Table or Calculator Function: Face Value of Bond Issuance from Future Value Market Interest Rate Present value of proceeds from bond issue Bond Issue Price as a Percentage of Face Value 2,900,000 71% $ 2,900,000 100% Required 1 Required 2 Required 3 Compute the bond issue proceeds assuming a market interest rate of 6 percent. (When computing proceeds, round the present value of the face amount and of the annual interest payment to the nearest thousand dollars. Enter your final answer in whole dollars.) Also, express the bond issue price as a percentage by comparing the total proceeds to the total face value. (Round "Bond Issue Price as a Percentage" to 2 decimal places.) Show less Present value of $1 $ Table or Calculator Function: Face Value of Bond Issuance from Future Value Market Interest Rate Present value of proceeds from bond issue Bond Issue Price as a Percentage of Face Value 2,900,000 6.00% % Required 1 Required 2 Required 3 Compute the bond issue proceeds assuming a market interest rate of 8 percent. (Wh present value of the face amount and of the annual interest payment to the nearest answer in whole dollars.) Also, express the bond issue price as a percentage by comp face value. (Round "Bond Issue Price as a Percentage" to 2 decimal places.) Present value of $1 $ Table or Calculator Function: Face Value of Bond Issuance from Future Value Market Interest Rate Present value of proceeds from bond issue Bond Issue Price as a Percentage of Face Value 2,900,000 8.00% %

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts