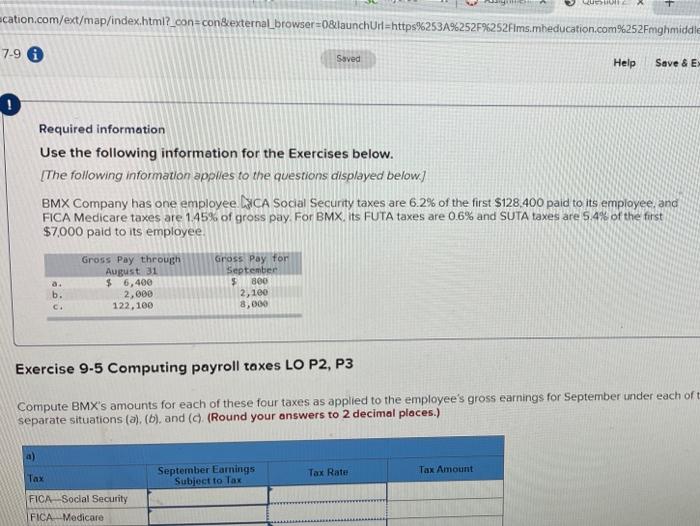

Question: Ecation.com/ext/map/index.html?_con-condexternal_browser=0&launchUrl=https%253A%252F%252Fims.mbeducation.com%252Fmghmiddle 7-9 Saved Help Save & E O Required information Use the following information for the Exercises below. [The following information applies to the questions

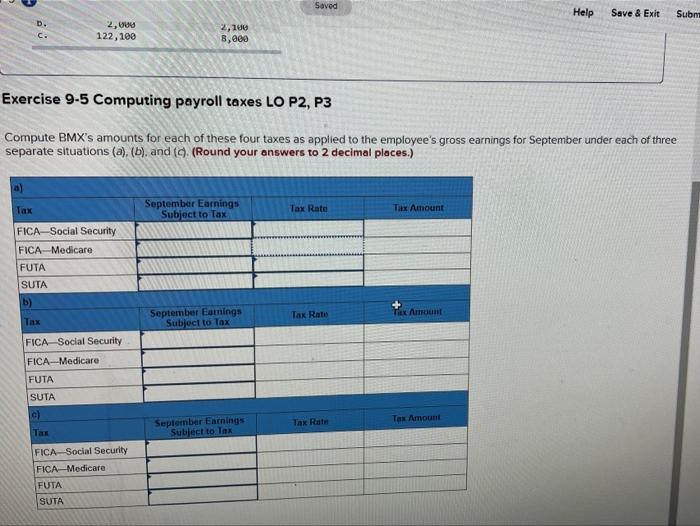

Ecation.com/ext/map/index.html?_con-condexternal_browser=0&launchUrl=https%253A%252F%252Fims.mbeducation.com%252Fmghmiddle 7-9 Saved Help Save & E O Required information Use the following information for the Exercises below. [The following information applies to the questions displayed below.) BMX Company has one employee. LYCA Social Security taxes are 6.2% of the first $128.400 paid to its employee, and FICA Medicare taxes are 145% of gross pay For BMX, its FUTA taxes are 0.6% and SUTA taxes are 5.4% of the first $7.000 paid to its employee 8. b. Gross Pay through August 31 $ 6,400 2,000 122,100 Gross Pay for September $ 800 2,100 8,000 Exercise 9-5 Computing payroll taxes LO P2, P3 Compute BMX's amounts for each of these four taxes as applied to the employee's gross earnings for September under each oft separate situations (a), (b), and ((Round your answers to 2 decimal places.) a) Tax Rate Tax Amount TAX September Earnings Subject to Tax FICA Social Security FICA Medicare Saved Help Save & Exit Subm D. C. 2,00 122, 100 2,100 8,000 Exercise 9-5 Computing payroll taxes LO P2, P3 Compute BMX's amounts for each of these four taxes as applied to the employee's gross earnings for September under each of three separate situations (a), (b), and (9. (Round your answers to 2 decimal places.) a) Tax September Earnings Subject to Tax Tax Rate Tix Amount FICA-Social Security FICA-Medicare FUTA SUTA b) Tax Rate Thx Am September Earnings Subject to Tax | FICA Social Security FICA-Medicare FUTA SUTA c) Tas September Earnings Subject to Tax Tax Rate Tax Amount FICA Social Security FICA-Medicare FUTA SUTA

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts