Question: EcoMotors's disclosure notes for the year ending December 31, 2017, included the following regarding its $0.001 par common stock: Employee Stock Purchase Plan Our

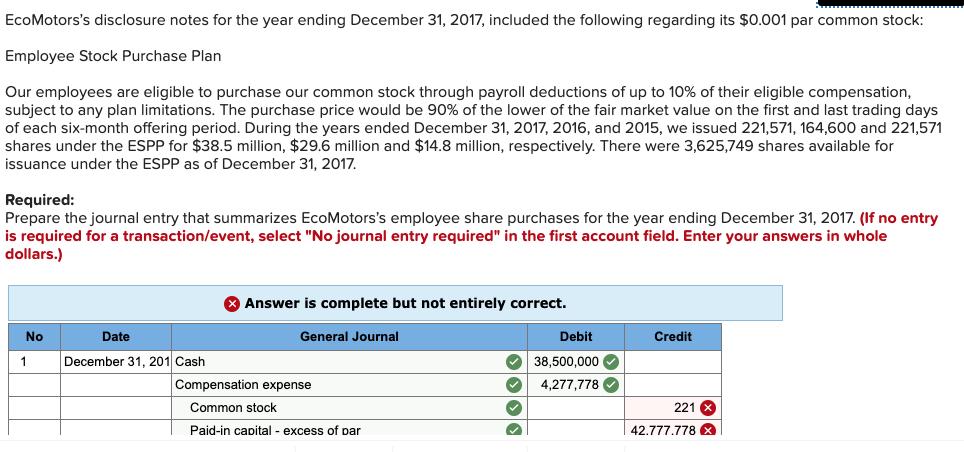

EcoMotors's disclosure notes for the year ending December 31, 2017, included the following regarding its $0.001 par common stock: Employee Stock Purchase Plan Our employees are eligible to purchase our common stock through payroll deductions of up to 10% of their eligible compensation, subject to any plan limitations. The purchase price would be 90% of the lower of the fair market value on the first and last trading days of each six-month offering period. During the years ended December 31, 2017, 2016, and 2015, we issued 221,571, 164,600 and 221,571 shares under the ESPP for $38.5 million, $29.6 million and $14.8 million, respectively. There were 3,625,749 shares available for issuance under the ESPP as of December 31, 2017. Required: Prepare the journal entry that summarizes EcoMotors's employee share purchases for the year ending December 31, 2017. (If no entry is required for a transaction/levent, select "No journal entry required" in the first account field. Enter your answers in whole dollars.) Answer is complete but not entirely correct. No Date General Journal Debit Credit 1 December 31, 201 Cash O 38,500,000 Compensation expense 4,277,778 O Common stock 221 X Paid-in capital - excess of par 42.777.778 &

Step by Step Solution

3.53 Rating (153 Votes )

There are 3 Steps involved in it

Answer Journal Entry Date Account title D... View full answer

Get step-by-step solutions from verified subject matter experts