Question: Econ 202 - Nelson Unit 8 Assignment Name I. The Bank of Nelson (BON) is a bank in the United States, with $8,000 cash in

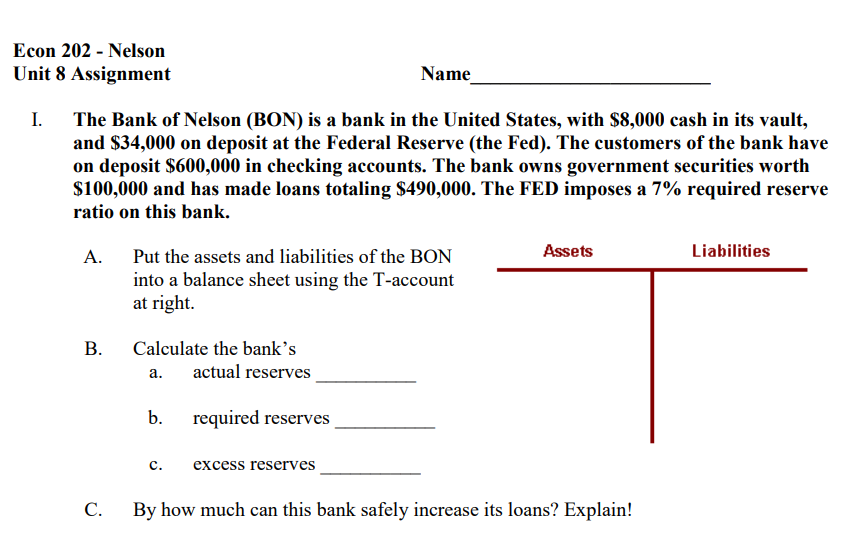

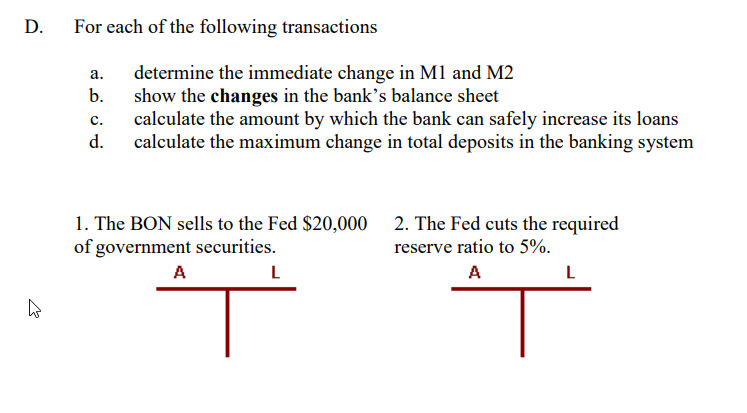

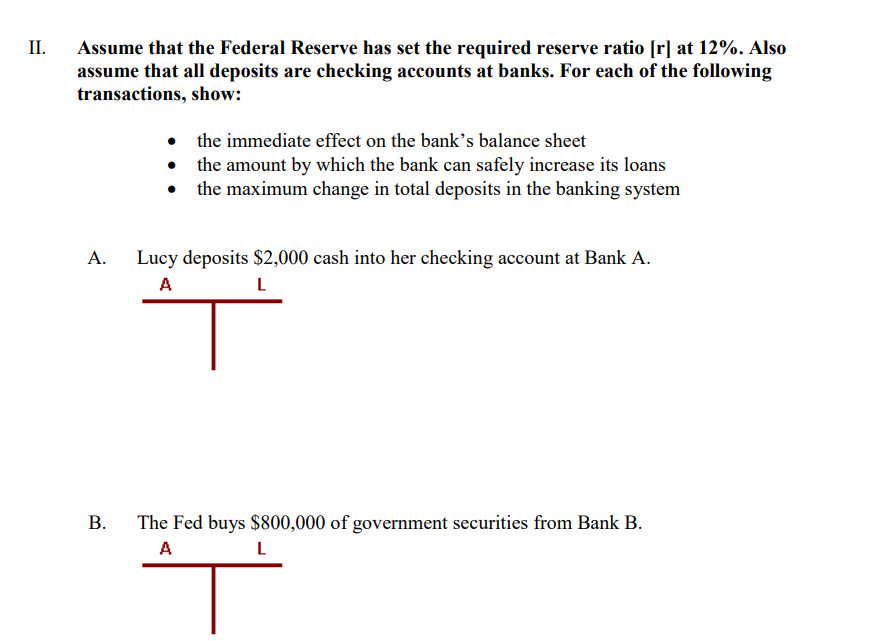

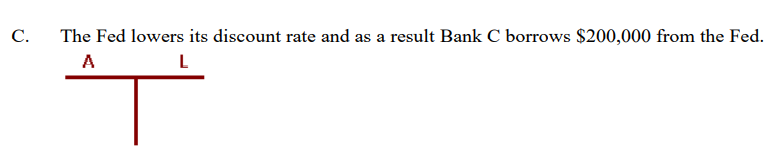

Econ 202 - Nelson Unit 8 Assignment Name I. The Bank of Nelson (BON) is a bank in the United States, with $8,000 cash in its vault, and $34,000 on deposit at the Federal Reserve (the Fed). The customers of the bank have on deposit $600,000 in checking accounts. The bank owns government securities worth $100,000 and has made loans totaling $490,000. The FED imposes a 7% required reserve ratio on this bank. A. Assets Liabilities Put the assets and liabilities of the BON into a balance sheet using the T-account at right B. Calculate the bank's a. actual reserves b. required reserves c. excess reserves C. By how much can this bank safely increase its loans? Explain! D. For each of the following transactions a. b. c. d. determine the immediate change in Ml and M2 show the changes in the bank's balance sheet calculate the amount by which the bank can safely increase its loans calculate the maximum change in total deposits in the banking system 1. The BON sells to the Fed $20,000 of government securities. A L 2. The Fed cuts the required reserve ratio to 5%. L no 'T II. Assume that the Federal Reserve has set the required reserve ratio [r) at 12%. Also assume that all deposits are checking accounts at banks. For each of the following transactions, show: the immediate effect on the bank's balance sheet the amount by which the bank can safely increase its loans the maximum change in total deposits in the banking system A. Lucy deposits $2,000 cash into her checking account at Bank A. A L B. The Fed buys $800,000 of government securities from Bank B. A L C. The Fed lowers its discount rate and as a result Bank C borrows $200,000 from the Fed. A L Econ 202 - Nelson Unit 8 Assignment Name I. The Bank of Nelson (BON) is a bank in the United States, with $8,000 cash in its vault, and $34,000 on deposit at the Federal Reserve (the Fed). The customers of the bank have on deposit $600,000 in checking accounts. The bank owns government securities worth $100,000 and has made loans totaling $490,000. The FED imposes a 7% required reserve ratio on this bank. A. Assets Liabilities Put the assets and liabilities of the BON into a balance sheet using the T-account at right B. Calculate the bank's a. actual reserves b. required reserves c. excess reserves C. By how much can this bank safely increase its loans? Explain! D. For each of the following transactions a. b. c. d. determine the immediate change in Ml and M2 show the changes in the bank's balance sheet calculate the amount by which the bank can safely increase its loans calculate the maximum change in total deposits in the banking system 1. The BON sells to the Fed $20,000 of government securities. A L 2. The Fed cuts the required reserve ratio to 5%. L no 'T II. Assume that the Federal Reserve has set the required reserve ratio [r) at 12%. Also assume that all deposits are checking accounts at banks. For each of the following transactions, show: the immediate effect on the bank's balance sheet the amount by which the bank can safely increase its loans the maximum change in total deposits in the banking system A. Lucy deposits $2,000 cash into her checking account at Bank A. A L B. The Fed buys $800,000 of government securities from Bank B. A L C. The Fed lowers its discount rate and as a result Bank C borrows $200,000 from the Fed. A L

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts