Question: ECON 3300 Assignment #3 - Part 1 - Decision Trees Note: Decision Trees must be typed/drawn (in Word, Excel etc.) or neatly handwritten/scanned and uploaded

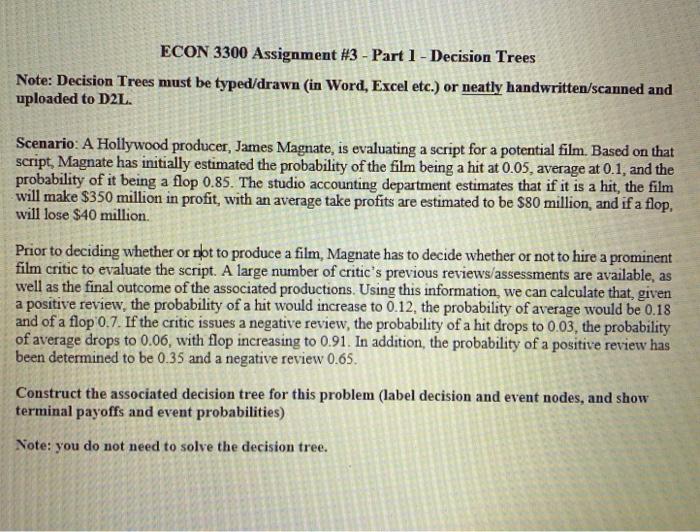

ECON 3300 Assignment #3 - Part 1 - Decision Trees Note: Decision Trees must be typed/drawn (in Word, Excel etc.) or neatly handwritten/scanned and uploaded to D2L. Scenario: A Hollywood producer, James Magnate, is evaluating a script for a potential film. Based on that script, Magnate has initially estimated the probability of the film being a hit at 0.05, average at 0.1, and the probability of it being a flop 0.85. The studio accounting department estimates that if it is a hit, the film will make $350 million in profit with an average take profits are estimated to be $80 million, and if a flop. will lose $40 million. Prior to deciding whether or not to produce a film, Magnate has to decide whether or not to hire a prominent film critic to evaluate the script. A large number of critic's previous reviews/assessments are available, as well as the final outcome of the associated productions. Using this information, we can calculate that given a positive review, the probability of a hit would increase to 0.12, the probability of average would be 0.18 and of a flop 0.7. If the critic issues a negative review, the probability of a hit drops to 0.03, the probability of average drops to 0.06, with flop increasing to 0.91. In addition, the probability of a positive review has been determined to be 0.35 and a negative review 0.65. Construct the associated decision tree for this problem (label decision and event nodes, and show terminal payoffs and event probabilities) Note: you do not need to solve the decision tree

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts