Question: econ hw please help 3. Consider a bank with the following assets and liabilities on its balance sheet: 90 in Treasury bonds: 30 in reserves;

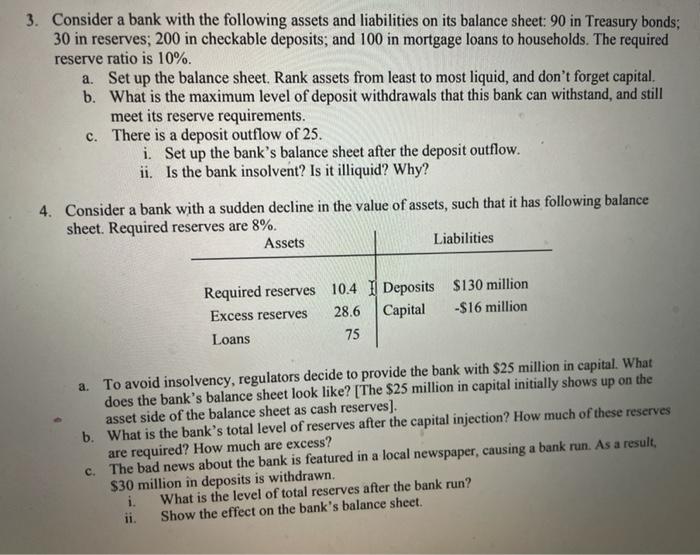

3. Consider a bank with the following assets and liabilities on its balance sheet: 90 in Treasury bonds: 30 in reserves; 200 in checkable deposits; and 100 in mortgage loans to households. The required reserve ratio is 10%. a. Set up the balance sheet. Rank assets from least to most liquid, and don't forget capital. b. What is the maximum level of deposit withdrawals that this bank can withstand, and still meet its reserve requirements. c. There is a deposit outflow of 25. i. Set up the bank's balance sheet after the deposit outflow. ii. Is the bank insolvent? Is it illiquid? Why? 4. Consider a bank with a sudden decline in the value of assets, such that it has following balance sheet. Required reserves are 8%. Assets Liabilities Required reserves 10.4 | Deposits $130 million Excess reserves 28.6 Capital -$16 million Loans 75 a. To avoid insolvency, regulators decide to provide the bank with $25 million in capital. What does the bank's balance sheet look like? [The $25 million in capital initially shows up on the asset side of the balance sheet as cash reserves]. b. What is the bank's total level of reserves after the capital injection? How much of these reserves are required? How much are excess? c. The bad news about the bank is featured in a local newspaper, causing a bank run. As a result, $30 million in deposits is withdrawn. i. What is the level of total reserves after the bank run? ii. Show the effect on the bank's balance sheet

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts