Question: econometrics problem.Please specify which answer is for which question.Thanks what info in the pics thas is all Aiming at finding out the macroeconomic determinants of

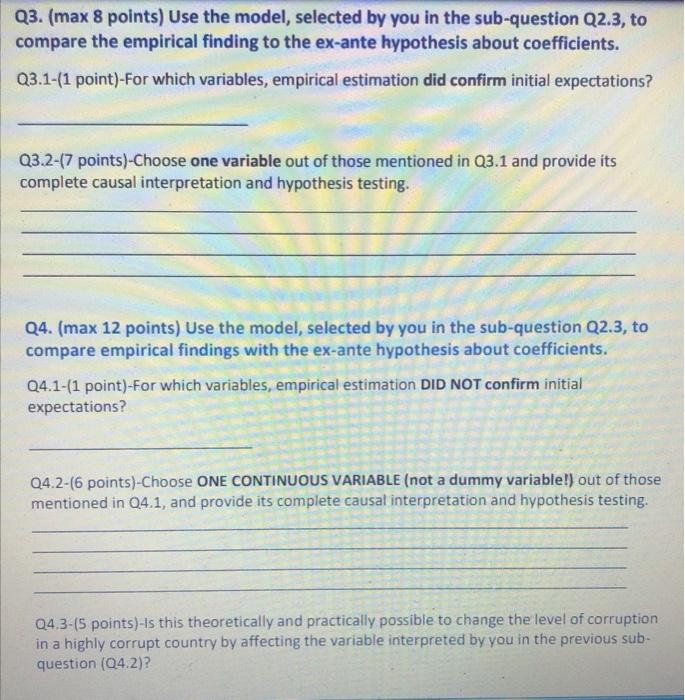

Aiming at finding out the macroeconomic determinants of corruption, researchers compiled a cross-sectional sample of 73 countries observed in the same year. The corruption level in each country was measured as a corruption index (variable ci). ci is a corruption score ranging from 0 to 100, where 100 corresponds to the most corrupt country and 0 to the least corrupt one. Besides ci, researchers also included the following variables: prot - % share of the population that are protestants; GDP - per capita GDP in Purchasing power parity $ (PPP); dem - dummy variable that is 1 for countries that had uninterrupted democracy in the past 50 years; colony - dummy variable that is 1 for countries that were former British colonies; com_law - dummy variable that is 1 for countries that implement principals of common law; fed - dummy variable that is 1 for countries that are organized as federations; The following econometric model of corruption was proposed: ci = f(prot, GDP,dem,colony.com_law) Ex-ante hypothesis about signs and values of coefficients Researchers anticipated that such factors as den, com law, GDP and fed would have a decreasing effect on the level of corruption while being a former colony would have an increasing effect. The effect of prot was expected to be neutral. Data printout, visualization and descriptive statistics are shown below: ci = f (prot, GDP,dem,colony,com_law) Ex-ante hypothesis about signs and values of coefficients Researchers anticipated that such factors as dem, com_law, GDP an decreasing effect on the level of corruption while being a former increasing effect. The effect of prot was expected to be neutral. Data printout, visualization and descriptive statistics are shown be R output Printout of the first 10 rows in the data set: dta ## # A tibble: 73 x 7 ## ci colony com law prot GDP dem fed ##

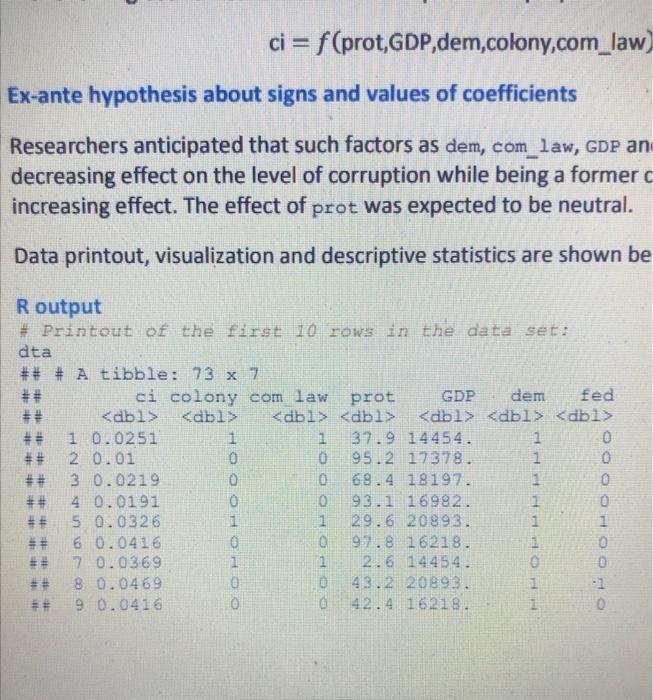

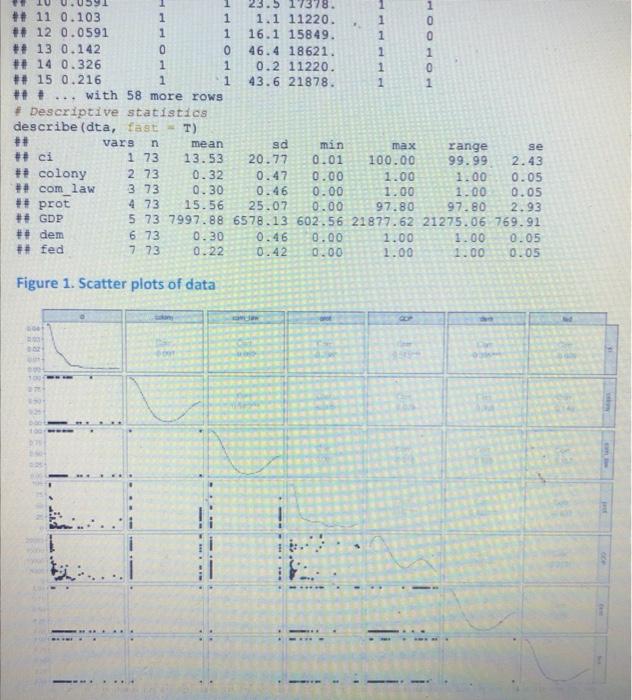

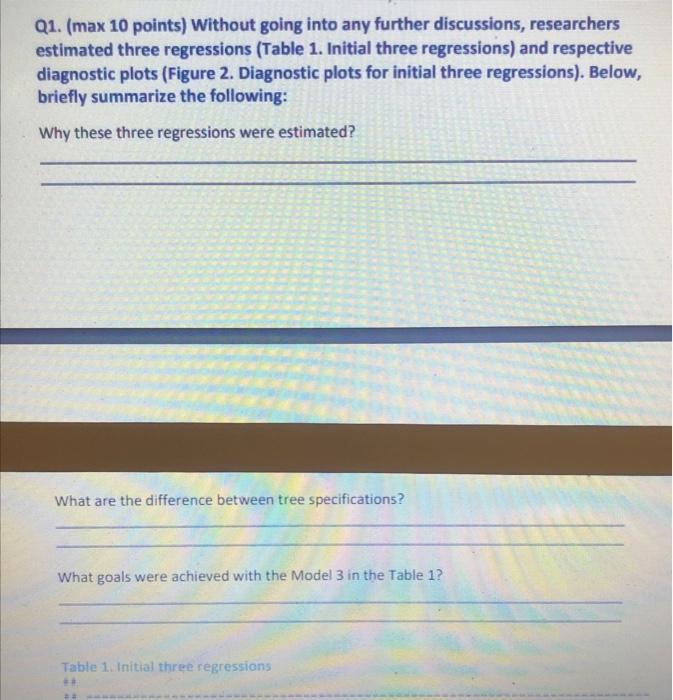

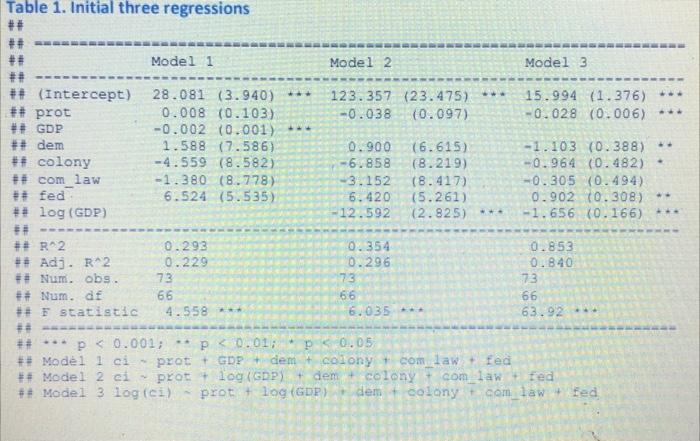

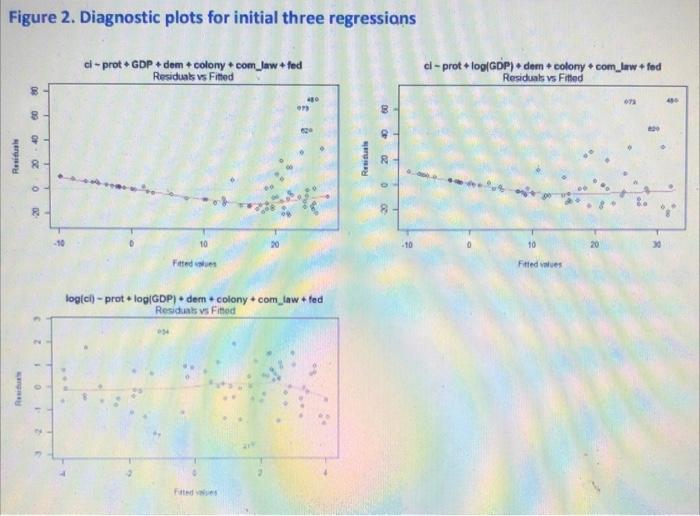

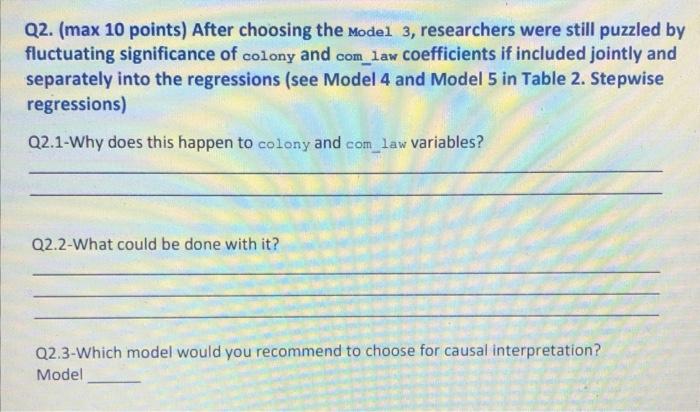

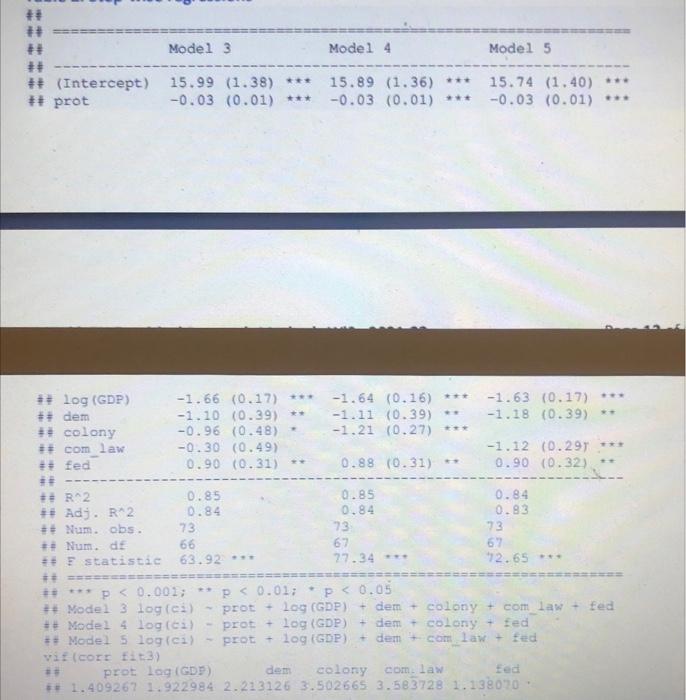

## 1 0.0251 1 37.9 14454. 1 ## 12 0.01 0 95.2 17378. 1 3 0.0219 0 69.4 18197. 1 ## 4 0.0191 0 93.1 16992. ## 5 0.0326 1 1 29.6 20893. 1 6 0.0416 97.8 16218. 1 70.0369 1 1 2.6 14454. 0 ## 8 0.0469 0 43.2 20893. ## 9 0.0416 42.4 16 218. 1 ### ## OOOHOOOH HHHH OOOOOOO 11 th 1 ODO 23.5 17378. 1 +# 11 0.103 1 1 1.1 11220 1 ## 12 0.0591 1 1 16.1 15849. 1 ## 13 0.142 0 0 46.4 18621. 1 1 ## 14 0.326 1 1 0.2 11220. 1 ## 15 0.216 1 1 43.6 21878. 1 1 ## # with 58 more rows # Descriptive statistics describe (dta, fast T) ## vars mean sd min max range se #ci 1 73 13.53 20.77 0.01 100.00 99.99 2.43 ## colony 2 73 0.32 0.47 0.00 1.00 1.00 0.05 # com law 3 73 0.30 0.46 0.00 1.00 1.00 0.05 ## prot 4 73 15.56 25.07 0.00 97.80 97.80 2.93 ## GDP 5 73 7997.88 6578.13 602.56 21877.62 21275.06 769.91 ## dem 6 73 0.30 0.46 0.00 1.00 1.00 0.05 ## fed 7 73 0.22 0.42 0.00 1.00 1.00 0.05 Figure 1. Scatter plots of data Q1. (max 10 points) Without going into any further discussions, researchers estimated three regressions (Table 1. Initial three regressions) and respective diagnostic plots (Figure 2. Diagnostic plots for initial three regressions). Below, briefly summarize the following: Why these three regressions were estimated? What are the difference between tree specifications? What goals were achieved with the Model 3 in the Table 1? Table 1. Initial three regressions Table 1. Initial three regressions ## Model 1 Model 2 Model 3 123.357 (23.475). -0.038 (0.097) 15.994 (1.376) -0.028 (0.006) +++ ## ## ## (Intercept) ## prot ## GDP ## dem ## colony ## com law ## fed # #log (GDP) ## ## R2 ## Adj. R^2 ## Num. obs. ## Num. dr ## F statistic 28.081 (3.940) *** 0.008 (0.103) -0.002 (0.001) ** 1.588 (7.586) -4.559 (8.582) -1.380 (8.778) 6.524 (5.535) 0.900 -6.858 -3.152 6.420 12.592 (6.615) (8.219) (8.417) (5.261) (2.825) -1.103 (0.388) -0.964 (0.482) -0.305 (0.494) 0.902 10.308) -1.656 (0.166) *** . 0.293 0.229 73 66 4.558 0.354 0.296 73 66 6.035 0.853 0.840 73 66 63.92 p

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts