Question: ECONOMETRICS Question 1 The regression results below are based on the model gdp = Bo+ Bixp; + B, cpi; + By fdi, + Bafdi, (-1)+

ECONOMETRICS

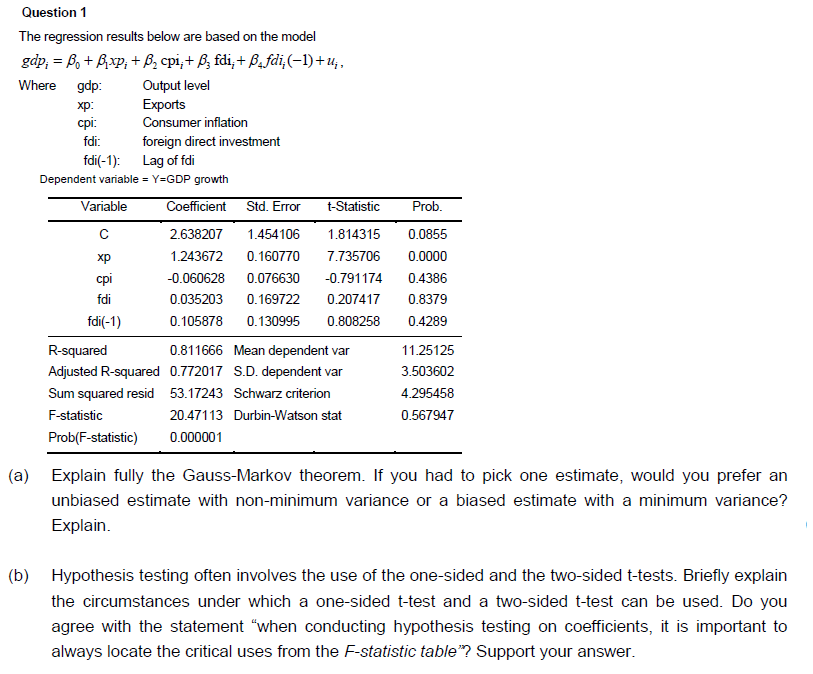

Question 1 The regression results below are based on the model gdp = Bo+ Bixp; + B, cpi; + By fdi, + Bafdi, (-1)+ 1; , Where gdp. Output level xp: Exports cpi: Consumer inflation fdi: foreign direct investment fdi(-1): Lag of fdi Dependent variable = Y=GDP growth Variable Coefficient Std. Error t-Statistic Prob. C 2.638207 1.454106 1.814315 0.0855 xp 1.243672 0.160770 7.735706 0.0000 cpi -0.060628 0.076630 -0.791174 0.4386 fdi 0.035203 0.169722 0.207417 0.8379 fdi(-1) 0. 105878 0. 130995 0.808258 0.4289 R-squared 0.811666 Mean dependent var 11.25125 Adjusted R-squared 0.772017 S.D. dependent var 3.503602 Sum squared resid 53.17243 Schwarz criterion 4.295458 F-statistic 20.47113 Durbin-Watson stat 0.567947 Prob(F-statistic) 0.000001 (a) Explain fully the Gauss-Markov theorem. If you had to pick one estimate, would you prefer an unbiased estimate with non-minimum variance or a biased estimate with a minimum variance? Explain. (b) Hypothesis testing often involves the use of the one-sided and the two-sided t-tests. Briefly explain the circumstances under which a one-sided t-test and a two-sided t-test can be used. Do you agree with the statement "when conducting hypothesis testing on coefficients, it is important to always locate the critical uses from the F-statistic table"? Support your

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts