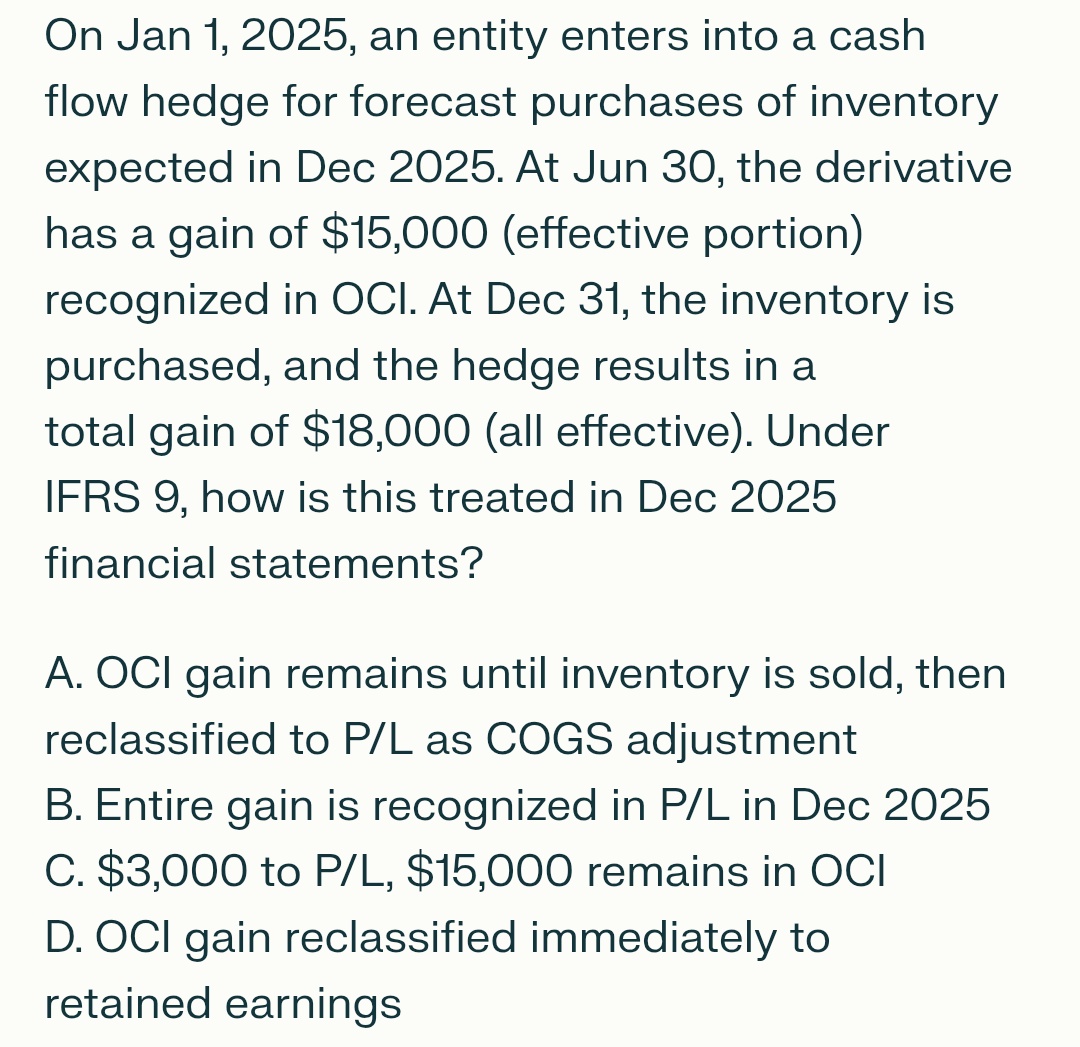

Question: Economic On Jan 1 , 2 0 2 5 , an entity enters into a cash flow hedge for forecast purchases of inventory expected in

Economic On Jan an entity enters into a cash flow hedge for forecast purchases of inventory expected in Dec At Jun the derivative has a gain of $effective portion recognized in OCl. At Dec the inventory is purchased, and the hedge results in a total gain of $all effective Under IFRS how is this treated in Dec financial statements? A OCI gain remains until inventory is sold, then reclassified to P L as COGS adjustment B Entire gain is recognized in mathrmPmathrmL in Dec C$ to P L$ remains in OCI D OCI gain reclassified immediately to retained earnings

Step by Step Solution

There are 3 Steps involved in it

1 Expert Approved Answer

Step: 1 Unlock

Question Has Been Solved by an Expert!

Get step-by-step solutions from verified subject matter experts

Step: 2 Unlock

Step: 3 Unlock