Question: Economics Consider the single index model regression R = a; +313; +mt = 1, ...,T,i = 1,... ,N Rm ~ Hal N(0,0';2) 6 ~ it'd

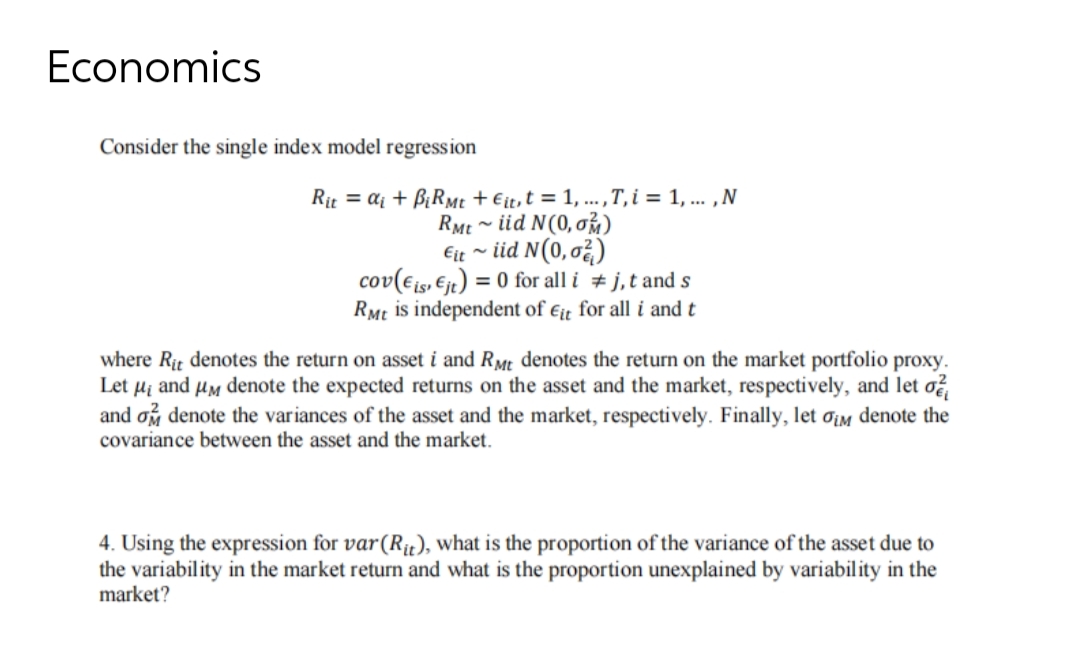

Economics Consider the single index model regression R" = a; +313"; +mt = 1, ...,T,i = 1,... ,N Rm ~ Hal N(0,0';2) 6\" ~ it'd N(D, org) cov(',, 51,) = O for all r' at: Ltand s R." is independent of E" for all i and t where R\" denotes the return on asset t' and R. denotes the return on the market portfolio proxy. Let #1 and m, denote the expected returns on the asset and the market, respectively, and let of, and of. denote the variances of the asset and the market, respectively. Finally, let em denote the covariance betweenthe asset and the market. 4. Using the expression for var-(Rn), what is the proportion of the variance of the asset due to the variability in the market return and what is the proportion unexplained by variability in the market

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts