Question: ect BCOR 340: Spring 2019 MWF Section 2 NANCE instructions I help (NPV, Valuation, Cost of Capital and Reviews) | Save &Exit!Submit Save & Exit

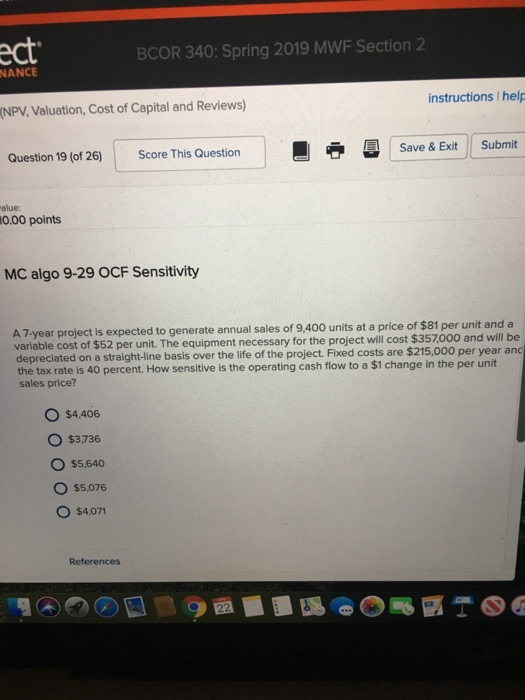

ect BCOR 340: Spring 2019 MWF Section 2 NANCE instructions I help (NPV, Valuation, Cost of Capital and Reviews) | Save &Exit!Submit Save & Exit ll submit Question 19 (of 26) Score This Question alue: 0.00 points MC algo 9-29 OCF Sensitivity A 7-year project is expected to generate annual sales of 9,400 units at a price of $81 per unit and a variable cost of $52 per unit. The equipment necessary for the project will cost $357,000 and will be depreciated on a straight-line basis over the life of the project. Fixed costs are $215,000 per year anc the tax rate is 40 percent. How sensitive is the operating cash flow to a $1 change in the per unit sales price? O $4,406 O $3736 o $5,640 O $5.076 O $4.071 References

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts