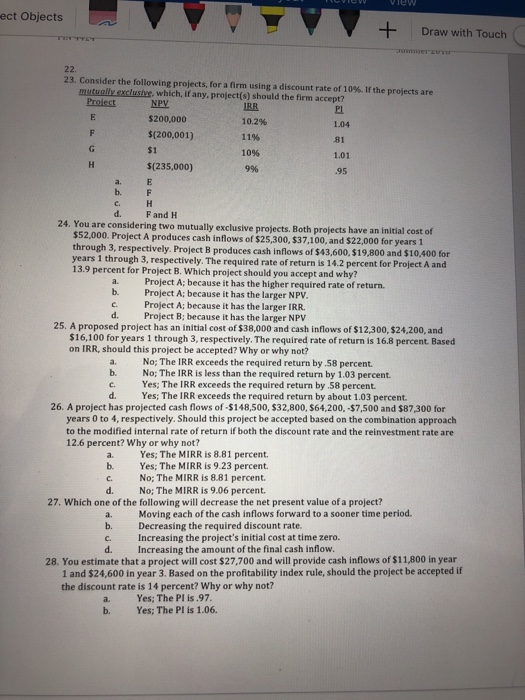

Question: ect Objects Draw with Touch 22. 23. Consider the following projects, for a firm using a discount rate of 10%. If the projects are mutually

ect Objects Draw with Touch 22. 23. Consider the following projects, for a firm using a discount rate of 10%. If the projects are mutually exclusive, which, if any, project(s) should the firm accept? NPV $200,000 $(200,001) $1 $(235,000) 10.2% 11% 1096 Pl 1.04 81 1.01 .95 d. Fand H 24. You are considering two mutually exclusive projects. Both projects have an initial cost of $52,000. Project A produces cash inflows of $25,300, $37,100, and $22,000 for years 1 through 3, years 1 through 3, respectively. The required rate of return is 14.2 percent for Project A and 13.9 percent for Project B. Which project should you accept and why? respectively. Project B produces cash inflows of $43,600, $19,800 and $10,400 for a. Project A; because it has the higher required rate of return. b. Project A; because it has the larger NPV c. Project A; because it has the larger IRR. d. Project B; because it has the larger NPV 25. A proposed project has an initial cost of $38,000 and cash inflows of $12,300, $24,200, and $16,100 for years 1 through 3, respectively. The required rate of return is 16.8 percent. Based on IRR, should this project be accepted? Why or why not? a. No; The IRR exceeds the required return by .58 percent b. No; The IRR is less than the required return by 1.03 percent. c. Yes; The IRR exceeds the required return by .58 percent. d. Yes; The I IRR exceeds the required return by about 1.03 percent. 26. A project has projected cash flows of $148,500, $32,800, $64,200,-$7,500 and $87 300 for years 0 to 4, respectively. Should this project be accepted based on the combination approach to the modified internal rate of return if both the discount rate and the reinvestment rate are 12.6 percent? Why or why not? a. Yes; The MIRR is 8.81 percent. b. Yes; The MIRR is 9.23 percent. C. No; The MIRR is 8.81 percent. d. No; The MIRR is 9.06 percent. 27. Which one of the following will decrease the net present value of a project? a. b. c. d. Moving each of the cash inflows forward to a sooner time period. Decreasing the required discount rate Increasing the project's initial cost at time zero. Increasing the amount of the final cash inflow. 28. You estimate that a project will cost $27,700 and will provide cash inflows of $11,800 in year 1 and $24,600 in year 3. Based on the profitability index rule, should the project be accepted if the discount rate is 14 percent? Why or why not? a. b. Yes; The PI is.97 Yes; The Pl is 1.06

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts