Question: ed The Alberta Mining and Export Corporation (AMEC) has operations at several locations throughout the province of Alberta in Western Canada. AMEC reports under

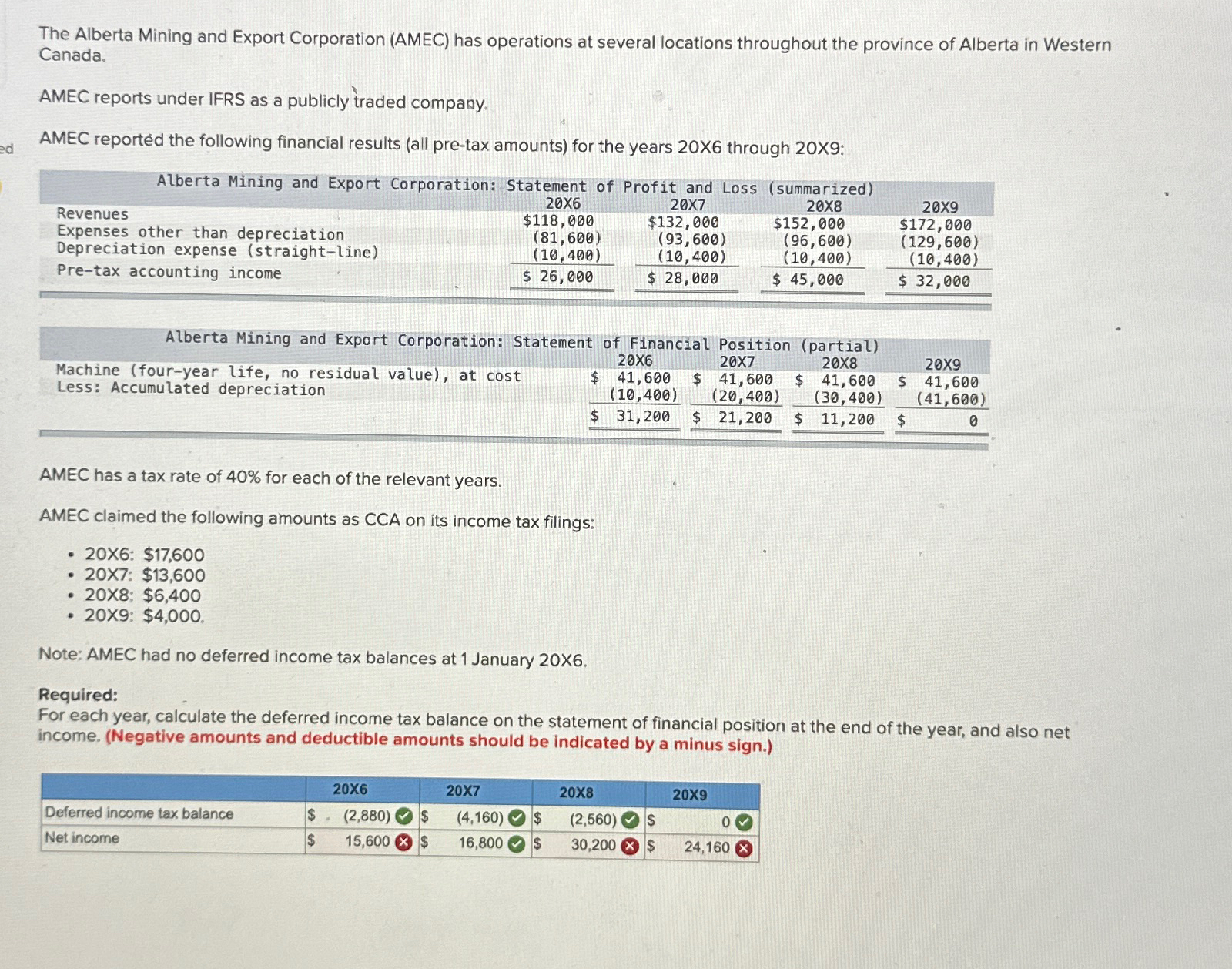

ed The Alberta Mining and Export Corporation (AMEC) has operations at several locations throughout the province of Alberta in Western Canada. AMEC reports under IFRS as a publicly traded company. AMEC reported the following financial results (all pre-tax amounts) for the years 20X6 through 20X9: Alberta Mining and Export Corporation: Statement of Profit and Loss (summarized) Revenues Expenses other than depreciation Depreciation expense (straight-line) Pre-tax accounting income 20X6 $118,000 (81,600) (10,400) 20X7 $132,000 (93,600) (10,400) 20X8 $152,000 (96,600) (10,400) 20X9 $172,000 (129,600) $ 26,000 $ 28,000 $ 45,000 (10,400) $ 32,000 Alberta Mining and Export Corporation: Statement of Financial Position (partial) Machine (four-year life, no residual value), at cost Less: Accumulated depreciation AMEC has a tax rate of 40% for each of the relevant years. AMEC claimed the following amounts as CCA on its income tax filings: 20X6: $17,600 20X7: $13,600 20X6 20X7 20X8 $ 41,600 $ 41,600 $ 41,600 $ 41,600 (10,400) (20,400) (30,400) (41,600) $ 31,200 $ 21,200 $ 11,200 $ 20X9 0 20X8: $6,400 20X9: $4,000. Note: AMEC had no deferred income tax balances at 1 January 20X6. Required: For each year, calculate the deferred income tax balance on the statement of financial position at the end of the year, and also net income. (Negative amounts and deductible amounts should be indicated by a minus sign.) Deferred income tax balance Net income 20X6 $ (2,880) $ $ 15,600 $ 20X7 20X8 20X9 (4,160) $ 16,800 $ (2,560) $ 30,200 $ 0 24,160 x

Step by Step Solution

There are 3 Steps involved in it

To calculate the deferred income tax balance on the statement of financial position at the end of ea... View full answer

Get step-by-step solutions from verified subject matter experts

Document Format (2 attachments)

663d6424656f0_967483.pdf

180 KBs PDF File

663d6424656f0_967483.docx

120 KBs Word File