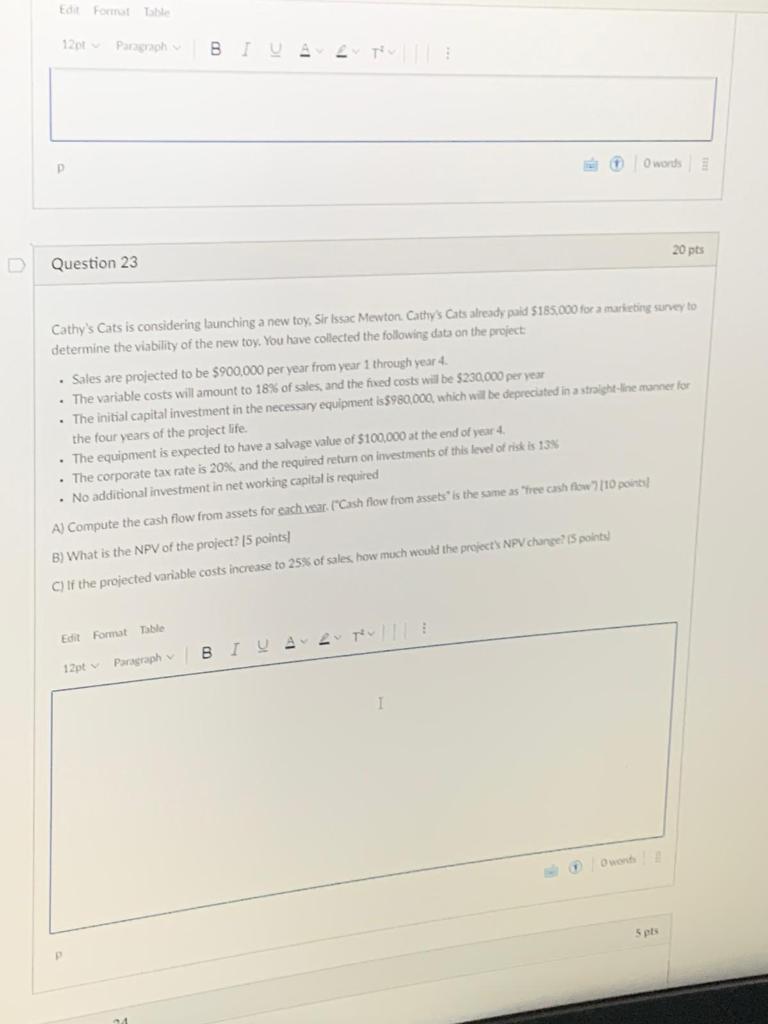

Question: Eda Format Table 1201 Parench BTA - TB O words 20 pts Question 23 Cathy's Cats is considering launching a new toy, Sir Issac Mewton

Eda Format Table 1201 Parench BTA - TB O words 20 pts Question 23 Cathy's Cats is considering launching a new toy, Sir Issac Mewton Cattiys Cats already paid $185.000 for a marketing survey to determine the viability of the new toy. You have collected the following data on the project Sales are projected to be $900,000 per year from year 1 through year 4. The variable costs will amount to 18% of sales, and the fixed costs will be $230,000 per year The initial capital investment in the necessary equipment isS980,000, which will be deprecated in a straight-line manner for the four years of the project life The equipment is expected to have a salvage value of $100.000 at the end of year 4 The corporate tax rate is 20% and the required return on investments of this level of risk is 13% No additional investment in net working capital is required A) Compute the cash flow from assets for each year. ("Cash flow from assets" is the same as "free cash flow 7/10 points B) What is the NPV of the project? (5 points C) If the projected variable costs increase to 25% of sales, how much would the projects NPV change? (5 points Edit Format u A2D 12pt Paragraph 1 Owento 5 pts

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts